Values: Market Report Series | $1M+ Condos & Townhouses | Greater Fort Lauderdale

KEY TAKEAWAYS

Greater Fort Lauderdale

Harbor Beach to Lighthouse Point

$1M+ Condos & Townhouses | April and Q1 2025

Hi there, Friends,

This is Jennie Frank Kapoor with Tropical Phoenix Homes. Welcome to, Key Takeaways, a monthly highlight as a part of my Values market report series. As we enjoy a brief South Florida Spring on the way to Summer, we take a macro level view of the $1M+ Greater Fort Lauderdale luxury condo and townhouse market from “harbor to lighthouse” and everything in-between.

This is a special edition where we discuss April and Q1 2025.

What are the trends? What does the data say? What are some key examples of market activity? And is the market hot or not?

We’ve got some great new enhancements and insights in our report this issue – you don’t want to miss this!

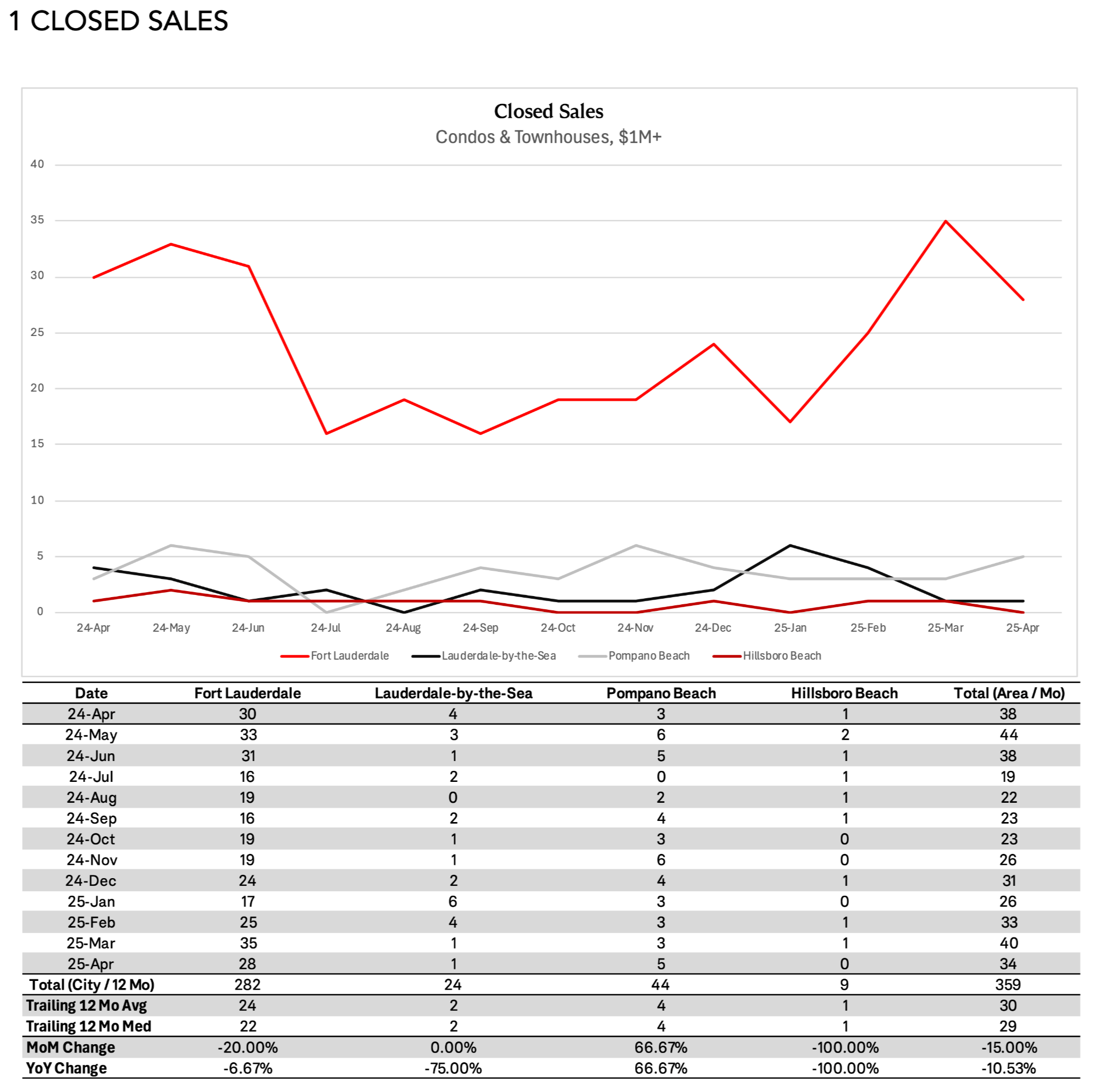

1 CLOSED SALES

Key Takeaways:

- There were 34 area closed sales in April, down about -10% year-over-year, but beating both the 12-mo trailing average and median (which are important to keep in mind as a baseline for this and all metrics we discuss).

- The start to this year has seen an uptick in sales compared to the last three months of 2024, demonstrating that deals have been getting done in the luxury sector.

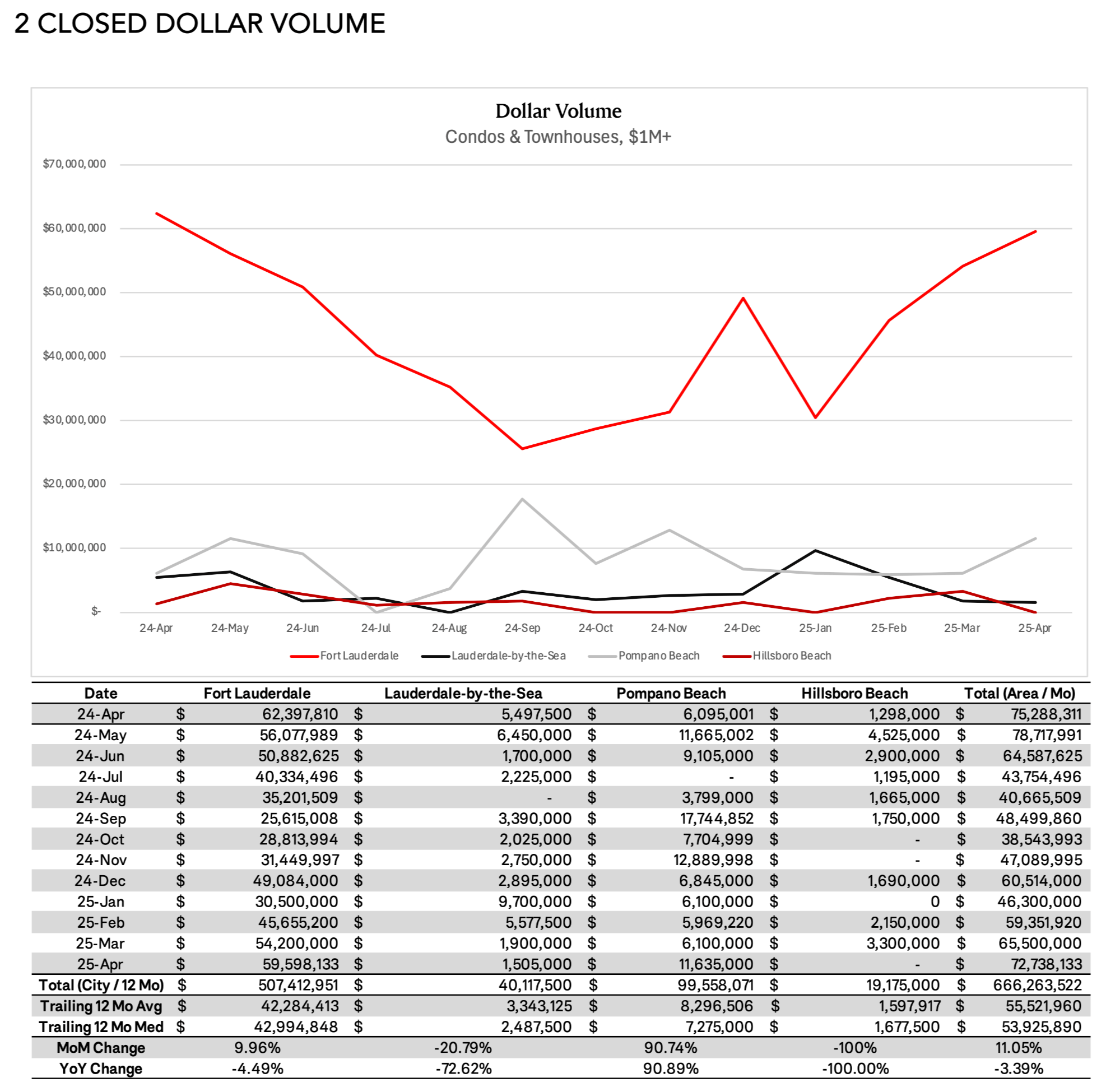

2 CLOSED DOLLAR VOLUME

Key Takeaways:

- Month-over-month (+11.05%), April saw a surge in closed dollar volume at $72.7M for the area – considerably better than both the trailing 12-mo average and median.

- While down slightly year-over-year (-3.39%), the start to 2025 has been considerably stronger than the end of 2024 in transactional dollar volume.

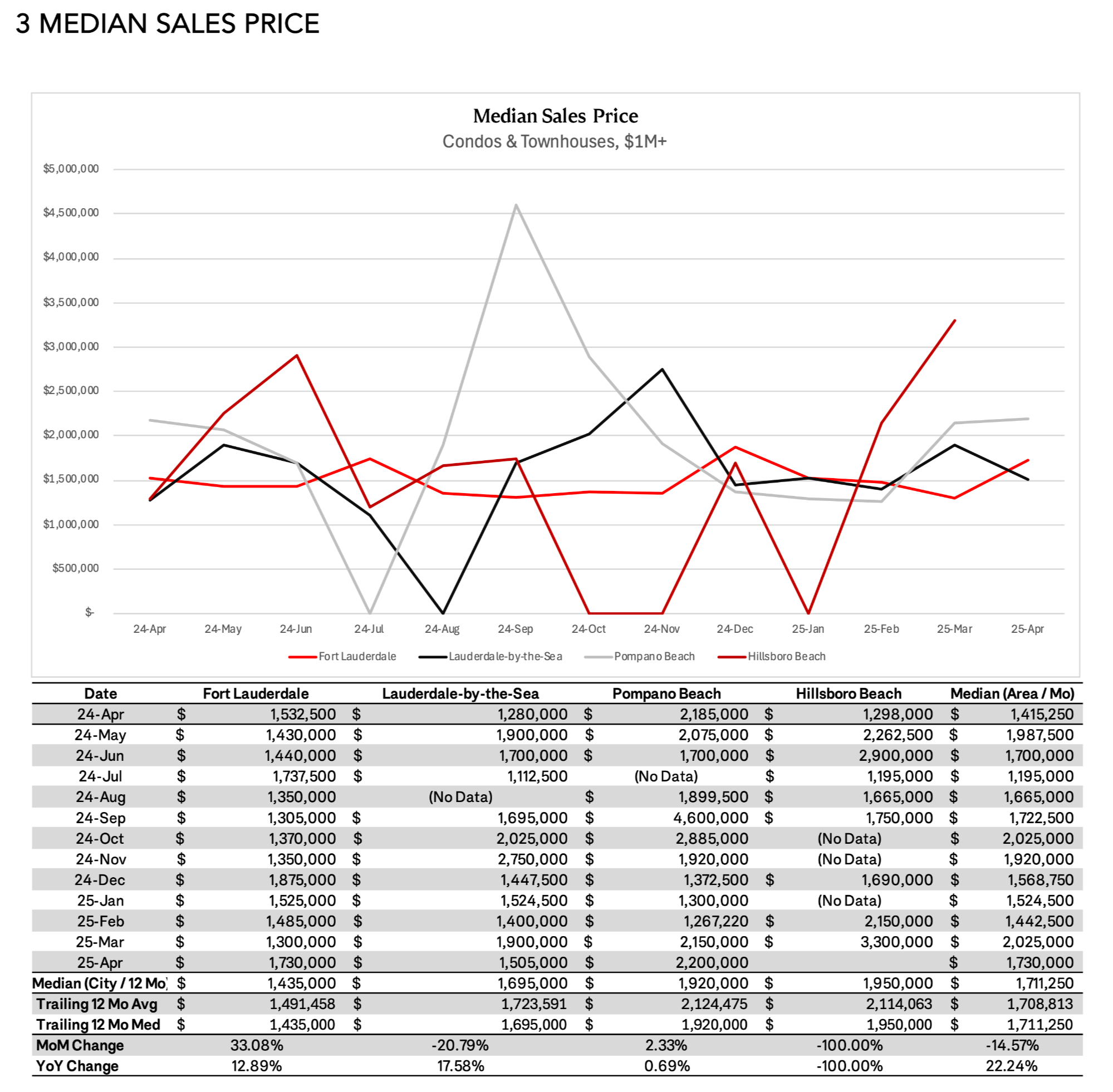

3 MEDIAN SALES PRICE

Key Takeaways:

- Supporting the surge in higher dollar volume accomplished with fewer transactions, the area median sales price in April is up +22.24% year-over-year at $1.73M – which is slightly higher than both the 12-mo trailing average and median.

- Nearly all of our sub-markets are also up over the year, a win for Greater Fort Lauderdale sellers.

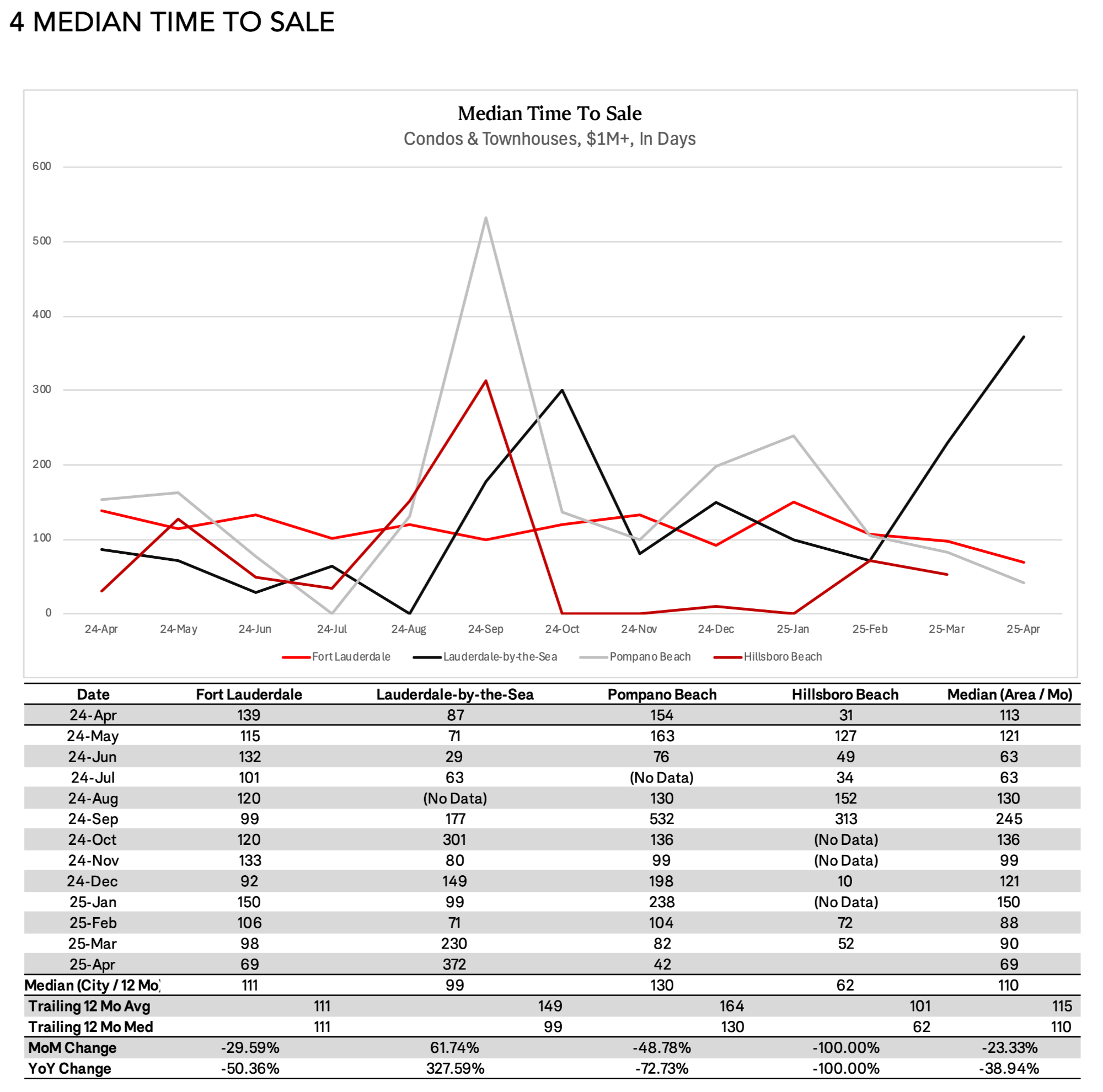

4 MEDIAN TIME TO SALE

Key Takeaways:

- Across the area, the blended median time to sale is down so far this year through April – which came in at a brisk 69 days (-23.33% MoM and -38.94% YoY).

- This continues a downward trend from late last year, and once again beats both the 12-mo trailing average and median.

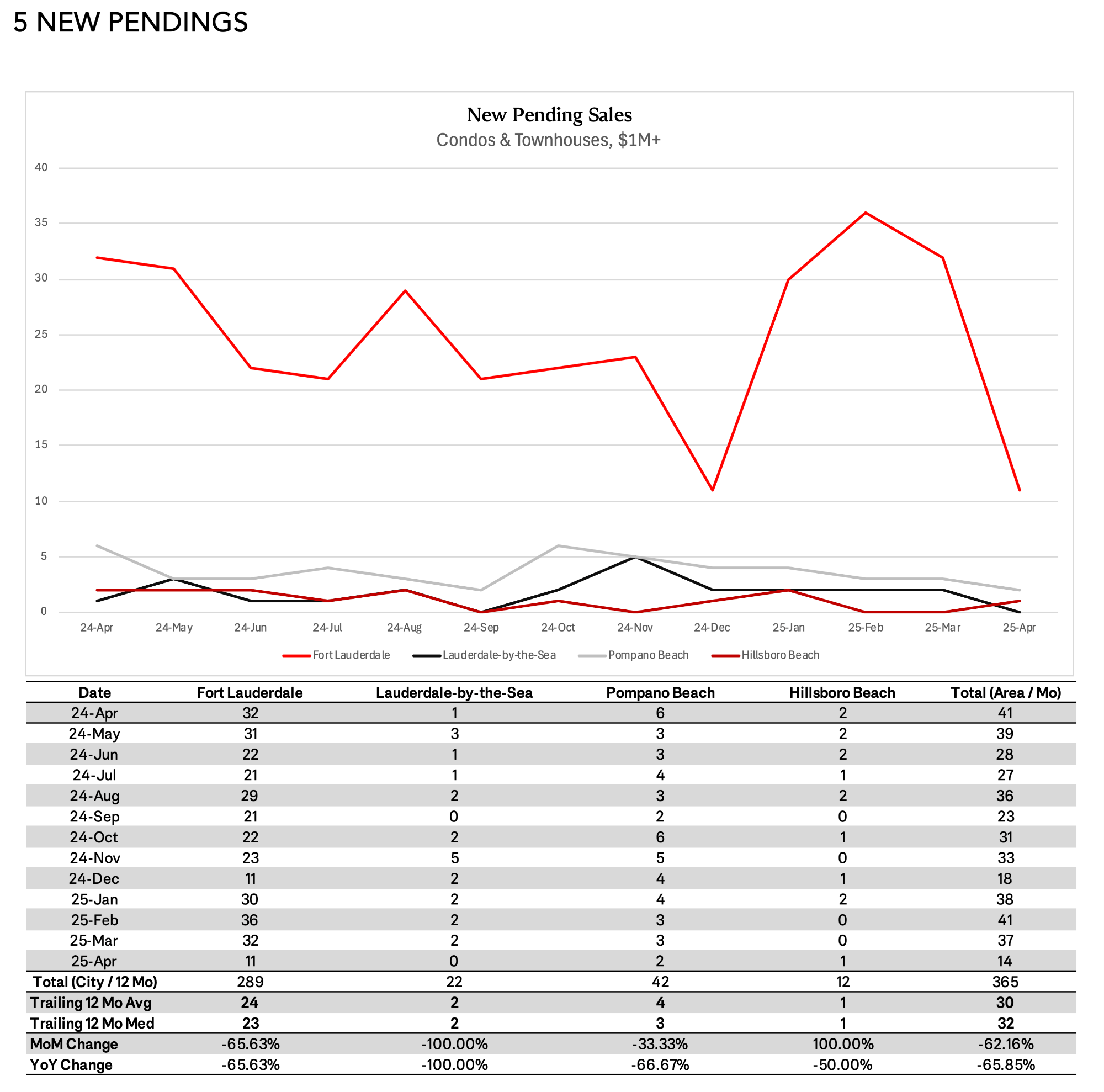

5 NEW PENDINGS

Key Takeaways:

- This is where the market activity starts to get interesting. So far reported, there are 14 new pending sales for the area. This is considerably down year-over-year (-65.85%) and month-over-month (-62.16%); also, the metric falls well short of the 12-mo trailing average and median for new contracts.

- Keep in mind that this metric does tend to get revised heading into the next month, but it is an early indication that activity is down with some of the macro-economic news we absorbed in April and it could forecast a slowdown in upcoming closings.

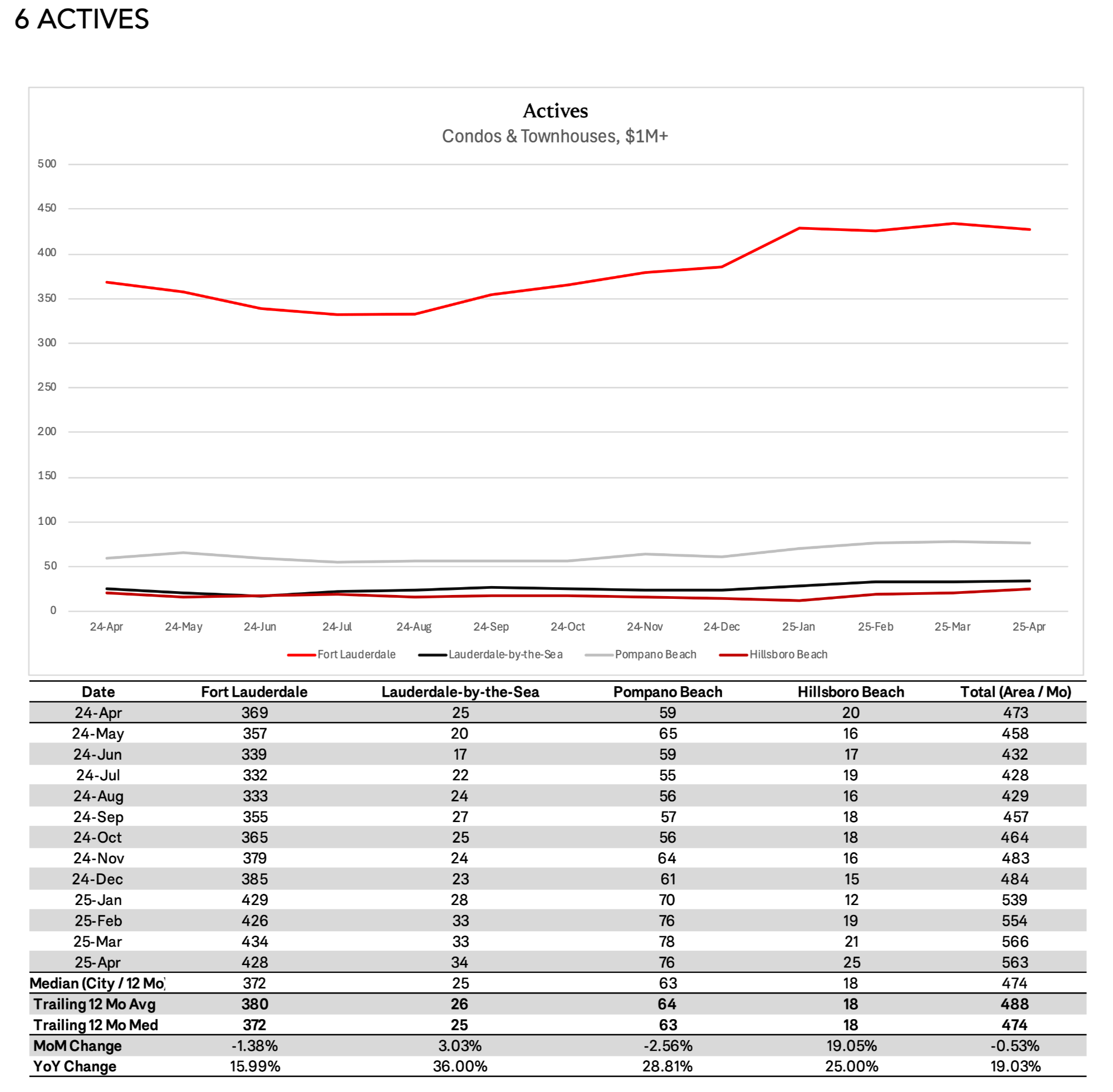

6 ACTIVES

Key Takeaways:

- Following national headlines, active inventory continues to trend upwards with 563 luxury properties reported on the market leaving April – which is up a blended +19.03% year-over-year in the area.

- The actives on market are also considerably higher than the 12-mo trailing average (488) and median (474), continuing a trend that started accelerating this January but has held relatively consistent month-over-month (-.53%).

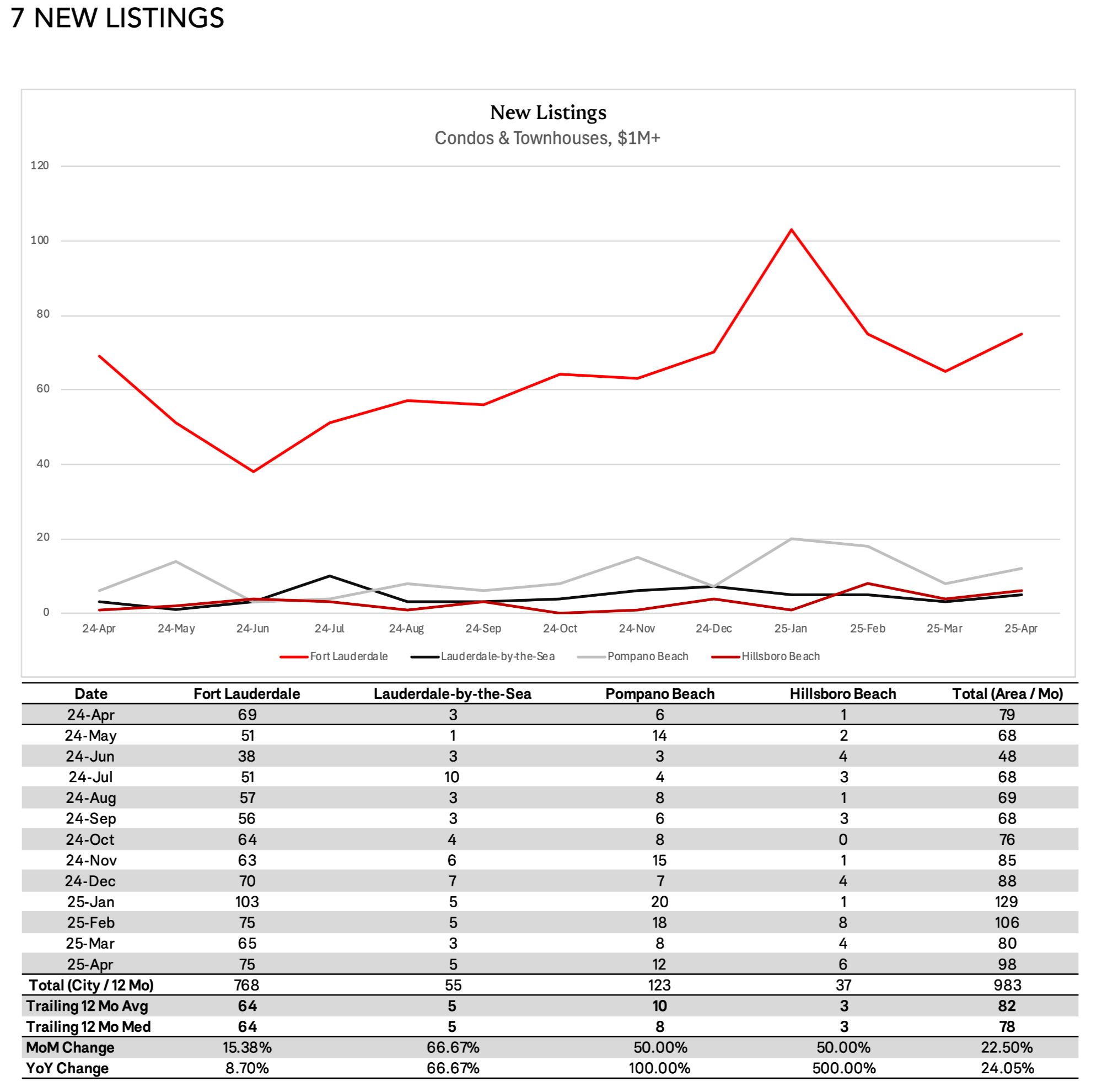

7 NEW LISTINGS

Key Takeaways:

- Consistent with overall active inventory, new luxury listings also increased in April to 98 – which is up both year-over-year (+24.05%) and month-over-month (+22.5%).

- This metric also surpasses the 12-mo trailing average and median.

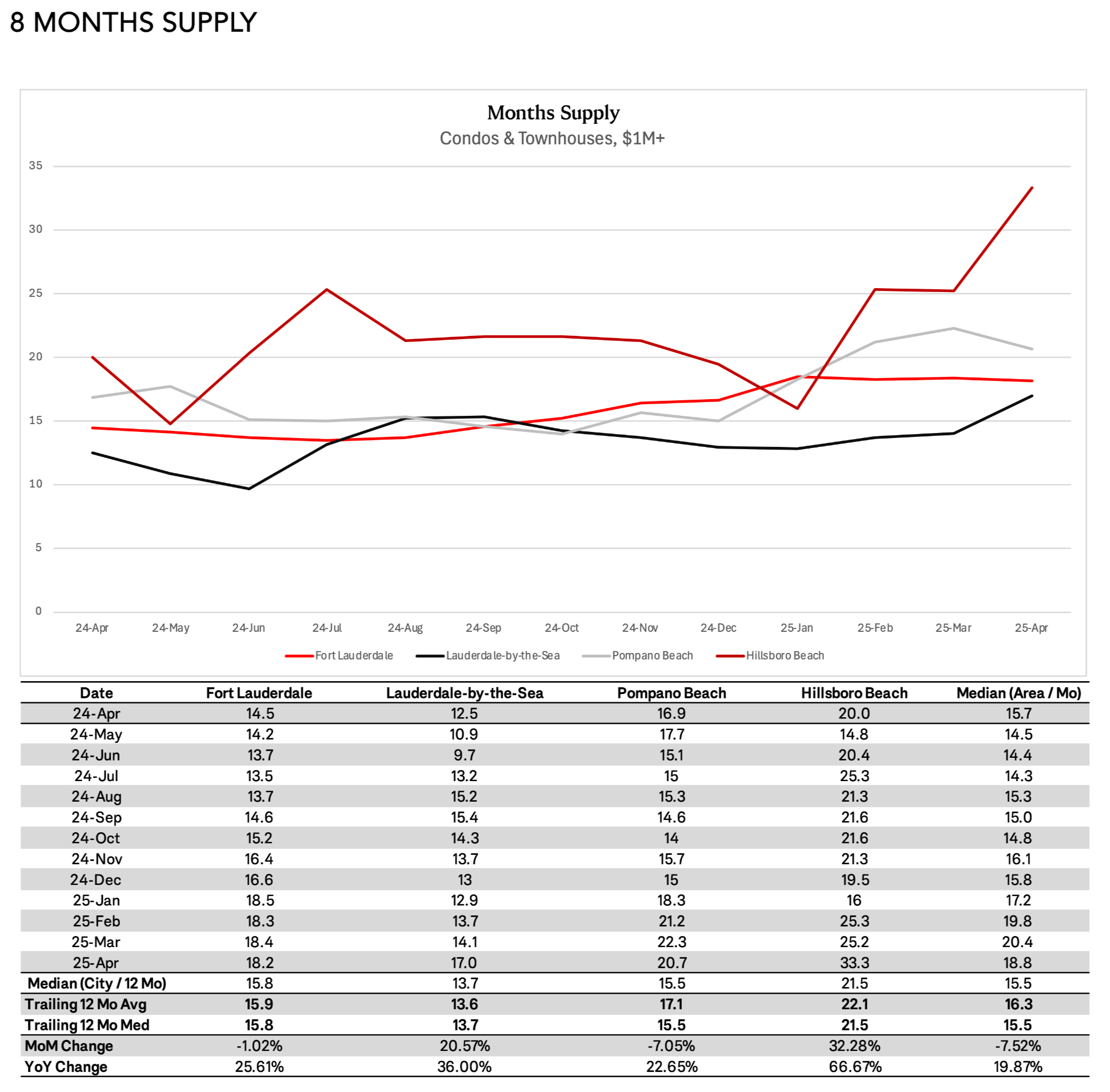

8 MONTHS SUPPLY

Key Takeaways:

- No surprises here – at a blended 18.8 months, luxury supply is up across the board for the area year-over-year (+19.87%), with a modest month-over-month decrease (-7.52%) following 89 properties removed from the active $1M+ market (canceled, withdrawn, expired and/or temp off market).

- With each of our subject markets within Greater Fort Lauderdale firmly in the double digits for this metric, April inventory comes in higher than both the 12-mo trailing average and median for the area, continuing a long-term supply trend.

- Equally important, one has to keep in mind the high amount of new development projects coming into Greater Fort Lauderdale, which is going to significantly add to the true luxury inventory available in the condo and townhouse market.

9 BUYERS VS SELLERS OR NEUTRAL

With all of this in mind, and there is a lot of commentary and noise on where we are as market right now, but I would consider us to still be within a strong buyer’s market for luxury condos and townhouses.

However, with that being said, we have seen a resilient luxury market through Q1 and April for sales with both strong pricing and dollar volume – contrary to much of the chatter that’s out there. It’ll be interesting to see where we go after the macro-environment turbulence we saw in April, which created a bit of a pause in that momentum, evident by the new pendings reported so far last month that are lower than trend.

Ok, next up, let’s zoom in from the macro view and take a closer look at some notable activity in the luxury market from April and Q1.

10 NOTABLE SALES

The two highest priced Greater Fort Lauderdale luxury condo and townhouse sales in April were:

- Waterfront:

- 525 N Fort Lauderdale Beach Blvd, Residence #1901, a stunning, 5-bedroom oceanfront penthouse at the renowned Four Seasons Residences in Central Beach, selling for $7.8M ($2,004 / SF). This building is certainly currently the benchmark for the sub-market with a number of sales surpassing $2,000 / SF.

- Inland:

- 1 N Ocean Blvd, Residence #1607, a rare high-floor, corner and flow through 3-bedroom unit with incredible views located at the prestigious Plaza at Oceanside in Pompano Beach, selling for $2.6M ($954 / SF). It just goes to show that you can find incredible views and value off the water.

Starting with this April issue, I wanted to provide new insights here that are examples of properties at, above, and below the area median sales price to give you an idea of how far your dollars can take you within Greater Fort Lauderdale:

- Around Median: 3100 N Ocean Blvd, Unit #1404, an updated and furnished 3-bedroom residence at the ocean-resort like, L’Hermitage, situated along Lauderdale Beach. Selling for $1.75M ($885 / SF).

- Above Median: 1796 Bay Dr, Residence #1796, an updated 3-bedroom townhouse located within the gated community of Hillsboro Bay by the Sea in Pompano Beach. Selling for $2.135M ($744 / SF), which I find represents incredible value so close to the ocean.

- Below Median: 807 NE 16th Ter, a beautiful, brand-new townhouse in Victoria Park featuring 3-bedrooms and selling for $1.27M ($491 / SF), which represents incredible value for east Fort Lauderdale. Great buy!

11 NOTABLE LISTINGS

Two notable recent luxury listings that are opportunities that I find interesting and would love to discuss further with you include:

- Waterfront:

- 57 Fort Royal Isle, which is a spectacular 8-bedroom estate with 129’ of prime water frontage in prestigious and gated Bermuda Riviera – one of my favorite communities anywhere, by the way! This property is great for either an end-user or as an investment, where it is currently generating over $400K annually on Airbnb.

- Asking $5.295M ($1,029 / SF), I believe this represents tremendous value for either a primary, secondary, or investment use.

- Listing by Engel & Völkers Fort Lauderdale

- Inland:

- 530 Birch Road #601, located within the new boutique development of Bungalow East of Central Breach in the charming North Beach Village neighborhood. This is a spectacular 4-bedroom residence in a very amenity rich building, just over a block away from the sand.

- Asking $3.029M ($1,070 / SF), I find it to be an excellent opportunity to get in early for one of the most desirable neighborhoods in all of Greater Fort Lauderdale. I’d love to tell you more about this project and why I find it to be a great buy for it’s combination of location, quality, amenities, and size.

- Listing by One World Properties

12 HOT OR NOT

So where is the Greater Fort Lauderdale luxury condo and townhouse market heading leaving April? And is the market Hot or Not?

Jennie says it’s – warm – and interesting.

Once again, more and more deals are happening, but it’s still a great time to be a selective buyer here in Greater Fort Lauderdale for this property type. With so many options, strong terms, especially if all cash and a quick close, can help secure a great price in a competitive market. But those waiting for prices to come down for quality product in premium locations, I believe, will be sorely disappointed.

***

And those are my Key Takeaways for the Greater Fort Lauderdale $1M+ luxury condo and townhouse market – from harbor to lighthouse – April and Q1 2025.

Are you interested in more analysis around South Florida? Schedule an appointment with me or visit my Values market reports and other series on my blog and podcast channels.

Thanks so much for joining me. This is Jennie Frank Kapoor of Tropical Phoenix Homes. Proudly a part of the Engel & Völkers global luxury network.

DISCLAIMERS AND NOTICES

- Data relied on within this blog and market report are from i) BeachesMLS and ii) MIAMI Association of REALTORS as of the date of this blog. This data is not verified for authenticity or accuracy and may not reflect all real estate activity in the market. Based on information © 2025 BeachesMLS, Inc.

- This blog and market report are not to be considered investment advice nor a solicitation for investment.

- Purchasing or selling real estate is an important financial decision. Make your own buying, selling, or investment decision based on your own analysis and due diligence, along with the consultation of your own professional advisors.

- The content of this blog and market report is for information and educational purposes only. Any commentary is solely the professional opinion of Jennie Frank Kapoor and/or Tropical Phoenix Homes and does not reflect the opinion of Engel & Völkers, any MLS, Florida Realtors, nor any other group. Errors and typos are possible, and you should verify all information before taking any actions.

- Copyright © 2025 of all original photos and content within this blog and market report, which are the property of Engel & Völkers, Jennie Frank Kapoor, Florida Realtors, and/or Tropical Phoenix Homes (“IP Holders”). No photos or content may be utilized or reproduced without the prior written consent of the IP Holders.

Categories

- All Blogs (55)

- Bahamas (5)

- Boca Raton (1)

- Brand Partners (1)

- Broward County (15)

- Capital Markets (1)

- Caribbean (2)

- Coconut Grove (2)

- Commercial Advisory and Development (1)

- Coral Gables (8)

- Delray Beach (1)

- E&V Global (3)

- Events (1)

- Fort Lauderdale (18)

- Foundations (1)

- Key Biscayne (1)

- Lauderdale-by-the-Sea (7)

- Market Report (19)

- Miami Beach (3)

- Miami-Dade County (4)

- New Construction and Development (2)

- News and Updates (13)

- On the Water (1)

- Open Houses (1)

- Opportunities (7)

- Palm Beach (Town) (2)

- Palm Beach County (3)

- Podcasts and Videos (13)

- Pompano Beach (3)

- REIMAGINE Renos and Rebuilds (1)

- Sea Ranch Lakes (8)

- South Florida (14)

- Thicken the Plot Series (8)

- Values Series (11)

- West Palm Beach (2)

Recent Posts