Values Series Palm Beach County

Values

A Data-Driven Insights Series for Luxury Real Estate

Palm Beach County

West Palm Beach | Palm Beach | Delray Beach | Boca Raton | All Palm Beach (County)

Welcome to the Values content series by Jennie Frank Kapoor of Tropical Phoenix Homes. In this series, we take a look at broader market-level insights and trends with a focus on the numbers in an executive summary format. This series will focus on monthly and quarterly updates with a bigger picture in mind. Coupled with our neighborhood and building deep dives, this will give my clients, prospective clients, and collaborators both the macro and micro views of the tropical markets we work within.

A Few General Notes About This Post:

- All data reflects criteria focused on $1M+ properties, where I specialize in for my sales and REIMAGINE businesses.

- All the data, charts, and analysis presented in this report are broken down between i) Single-Family Homes (SFHs) and ii) Townhouses / Condos to give a more accurate view to our audience of property types and their performance in the market.

- This report has a date range focused on June 2023 through June 2024 / Q2. July will be a part of my next report once source data is verified and closed for the month through Florida Realtors.

- Information is segmented by the local markets I specifically cover for sales and REIMAGINE projects. We also zoom out to the broader South Florida counties for context.

Counties and Cities:

- Miami-Dade (click here to read)

- Coral Gables

- Coconut Grove (Miami)

- Key Biscayne

- Miami Beach

- Broward (click here to read)

- Fort Lauderdale

- Sea Ranch Lakes

- Lauderdale-by-the-Sea

- Pompano Beach

- Palm Beach (this post)

- For an insightful micro-level understanding of the market, please dig into my neighborhood deep dives and community pages. It's also my pleasure to prepare a complimentary market analysis and broker opinion of value for anyone looking to buy or sell a primary residence, secondary home, or investment property.

WEST PALM BEACH

I. Single Family Homes (SFHs)

View Available ListingsSnapshot

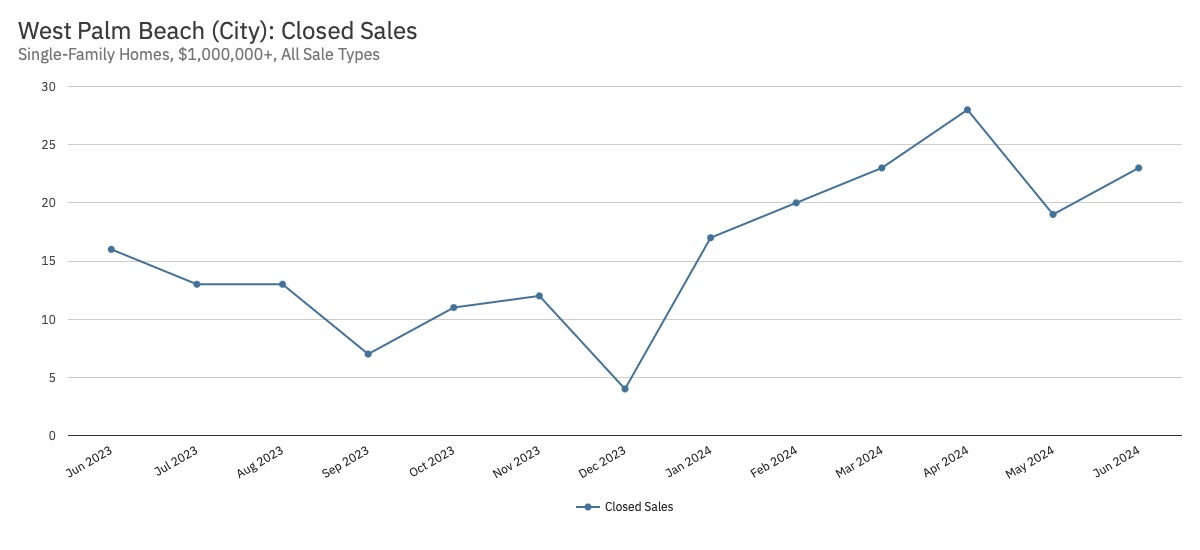

Closed Sales

Observations:

- Luxury Single Family Homes (SFHs) in West Palm Beach have seen an increased trajectory in closed sales since the turn of the year (following a period of decline during the second half of 2023). Additionally, 8 out of the last 12 months have seen positive gains year-over-year (YoY). As demand has soared for Palm Beach and South Florida luxury homes, West Palm Beach has been a beneficiary of the great wealth migration as well.

Total Dollars Closed

Observations:

- Mimicking the metric above, total dollars closed of luxury SFHs in West Palm Beach have seen an increase in volume since the turn of the year. 5 of the last 7 months have seen strong YoY gains compared to the prior year as well. This data further supports the West Palm Beach growth story finding another gear in 2024.

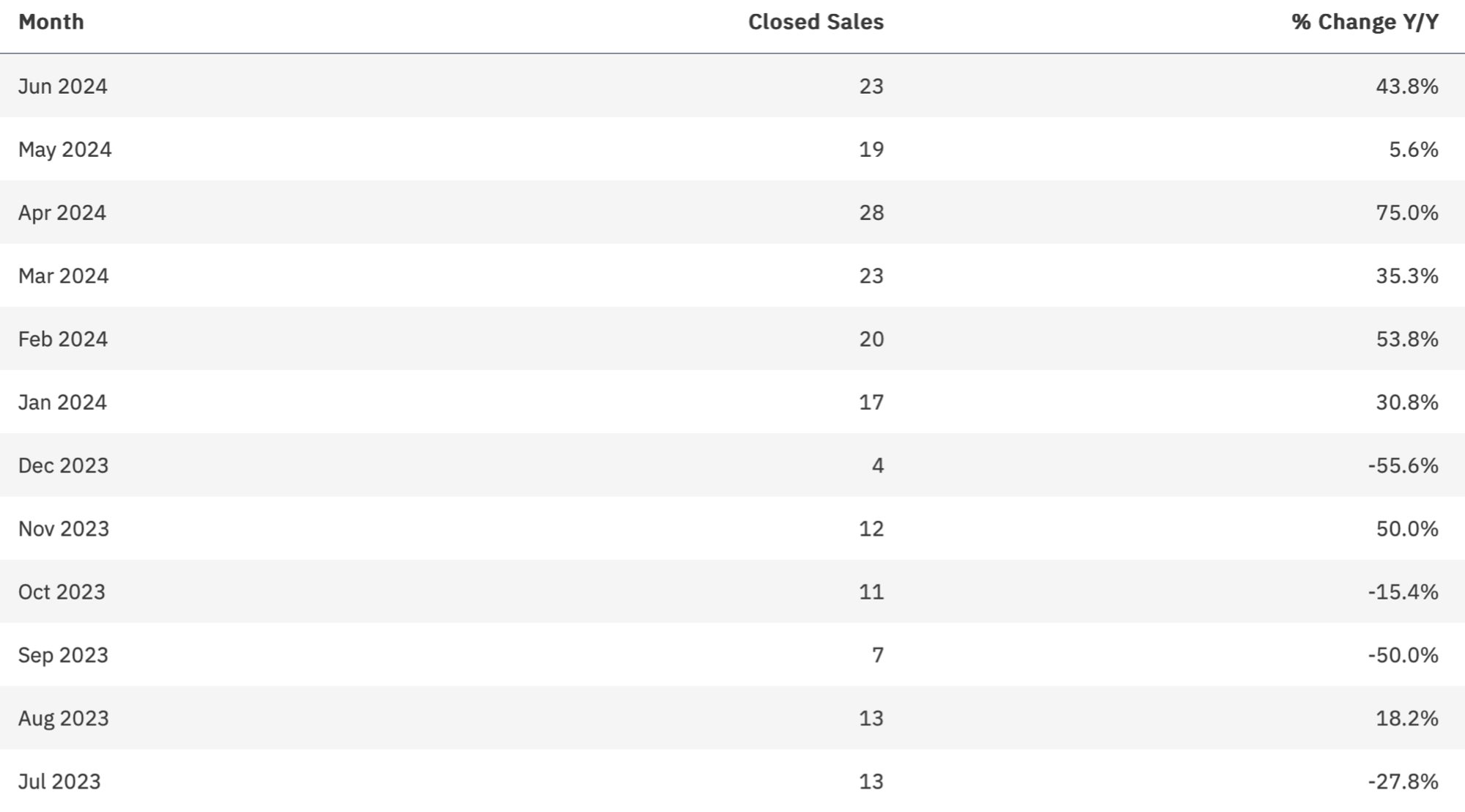

Median Sales Price

Observations:

- The median sales price for luxury SFHs in West Palm Beach has fluctuated within a consistent range over the last year, trending down in June recently. That said, 8 out of the last 12 months have also seen positive YoY change, and while down this year, June is still up compared to 2023. Along with the metrics above, the data reinforces the growth story here in 2024.

Median Time to Closed Sale

Observations:

- The median time to closed sales of luxury SFHs in West Palm Beach has been relatively steady over the last year (with a few slow periods around summer). Nine of the last 12 months have seen an increase in time to the closing table YoY. The time on market is just a tad slower on median compared to other communities in South Florida, although largely within the 4–6 months most luxury sellers with realistic pricing goals should expect.

Active Inventory

Observations:

- Contrary to national, regional, and local trends, active inventory of luxury SFHs in West Palm Beach has been declining consistently in 2024 following strong sales activity. Eight out of the last 12 months have seen YoY gains; however, the last 4 months are also in decline compared to the prior year.

New Listings

Observations:

- Contrary to national, regional, and local trends, new listing inventory of luxury SFHs in West Palm Beach has been declining consistently in 2024 following strong sales activity. 8 out of the last 12 months have seen YoY gains, although 2 of the last 4 months are in decline.

Months of Supply

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Contrary to national, regional, and local trends, supply is down considerably this year, with consistently dropping luxury SFH inventory each month. This is reflected in both nominal listings as well as YoY change since January. For this property type, the data indicates it’s a buyers’ market, but deals are getting done and inventory is dropping. It’ll be interesting to see where the market goes heading into the fall and winter selling seasons.

II. CONDOS AND TOWNHOUSES

View Available ListingsSnapshot

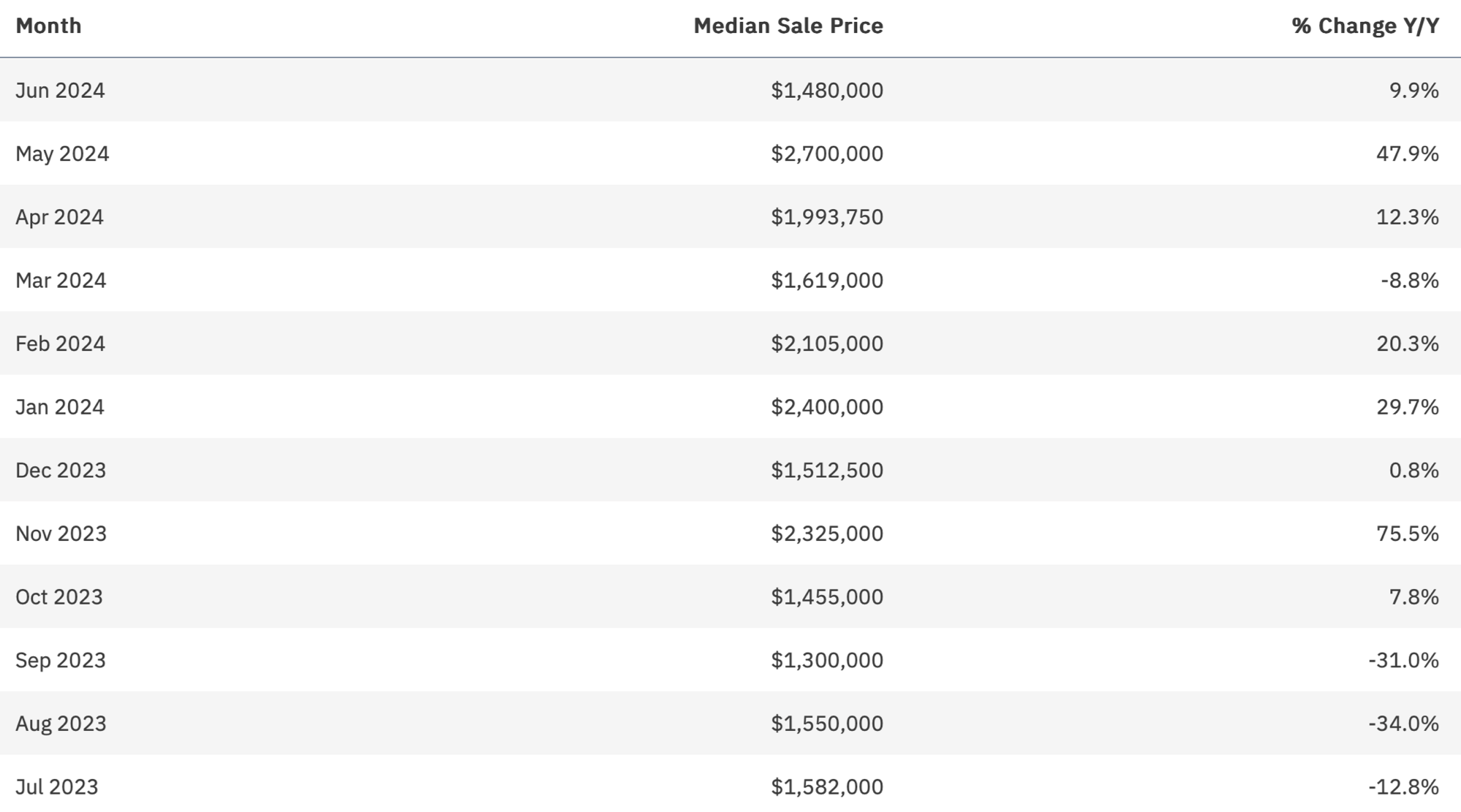

Closed Sales

Observations:

- Closed sales of West Palm Beach luxury townhouses / condos have declined over the last year in what is a relatively limited market size compared to other areas of South Florida; however, we’ve seen a rebound in sales activity since March. 8 of the last 12 months have seen YoY gains of closed sales for luxury units here.

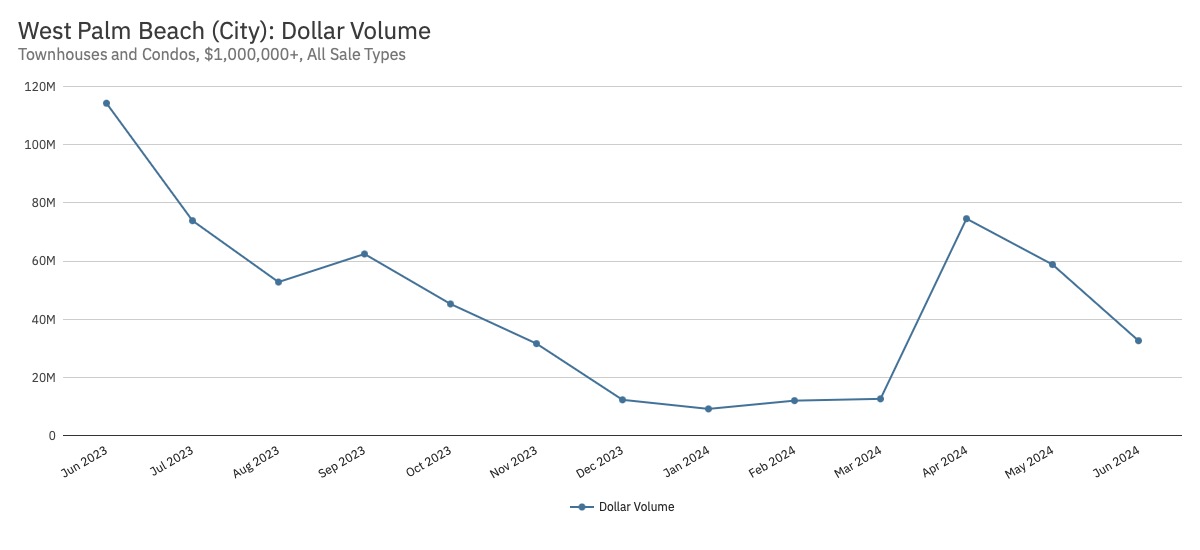

Total Dollars Closed

Observations:

- Total dollars closed of West Palm Beach luxury townhouses / condos have also declined over the last year with a slight rebound recently. However, 7 of the last 12 months have seen YoY gains of closed dollar volume for luxury units here in what is a limited market (but growing with delivery of new product).

Median Sales Price

Observations:

- Consistent with the story of the metrics above, median sales pricing of luxury townhouses / condos in West Palm Beach has been trending down for much of the last year. Generally speaking, there has been an extended period of a cooling market for this product type. However, the market has seen 7 of the last 12 months up in median sales pricing YoY following the closings of some prominent units in signature new buildings.

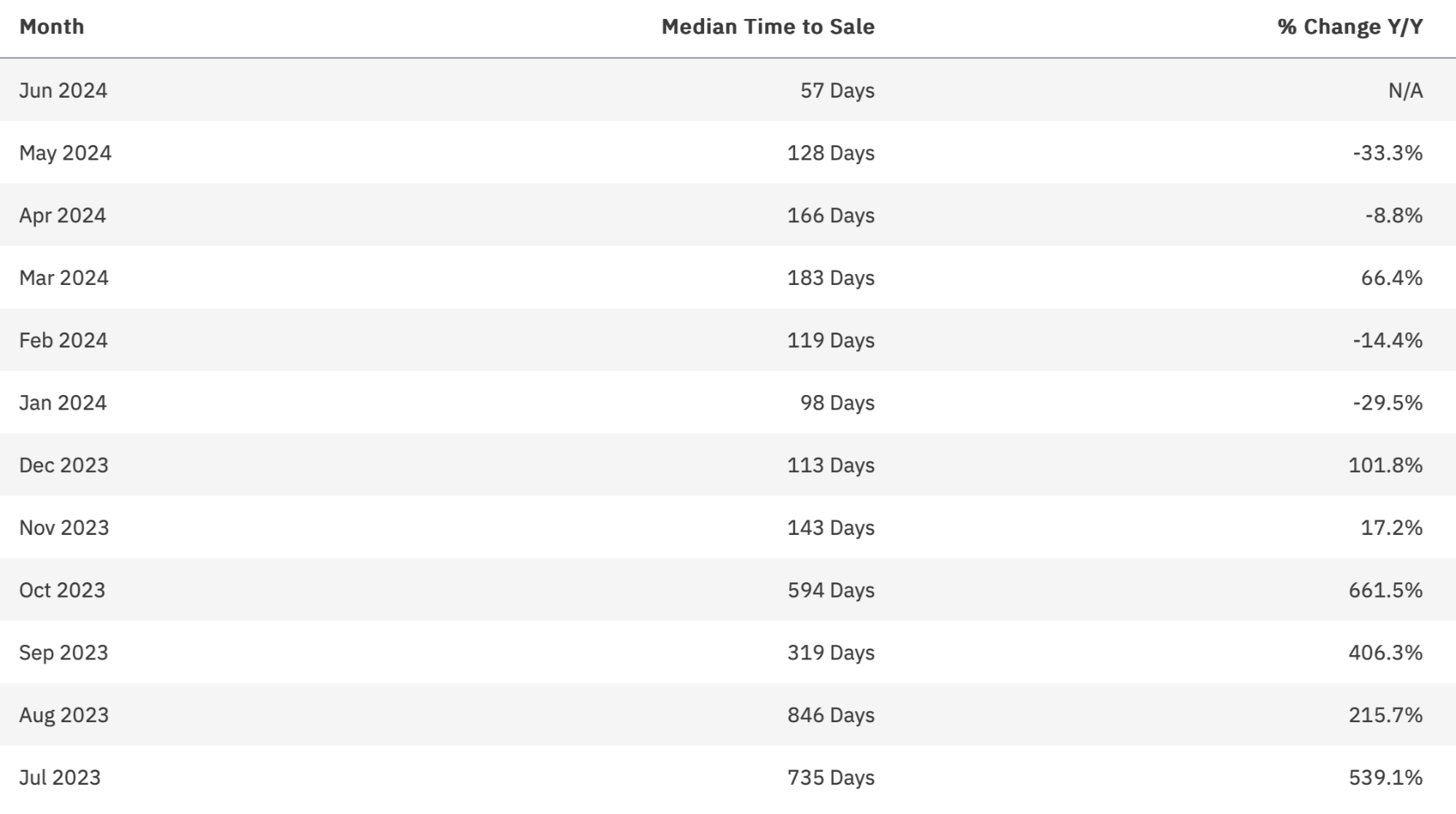

Median Time to Closed Sale

Observations:

- This metric is a bit misleading due to closings of new construction projects affecting the timelines with units on the MLS for long periods of time. I’ll recast my observations from November 2023, where you see a median time to closed sales for luxury townhouses / condos in West Palm Beach consistent with other South Florida markets, albeit on the higher side. Most luxury sellers should expect 4–6 months to transact for this product type with realistic pricing goals.

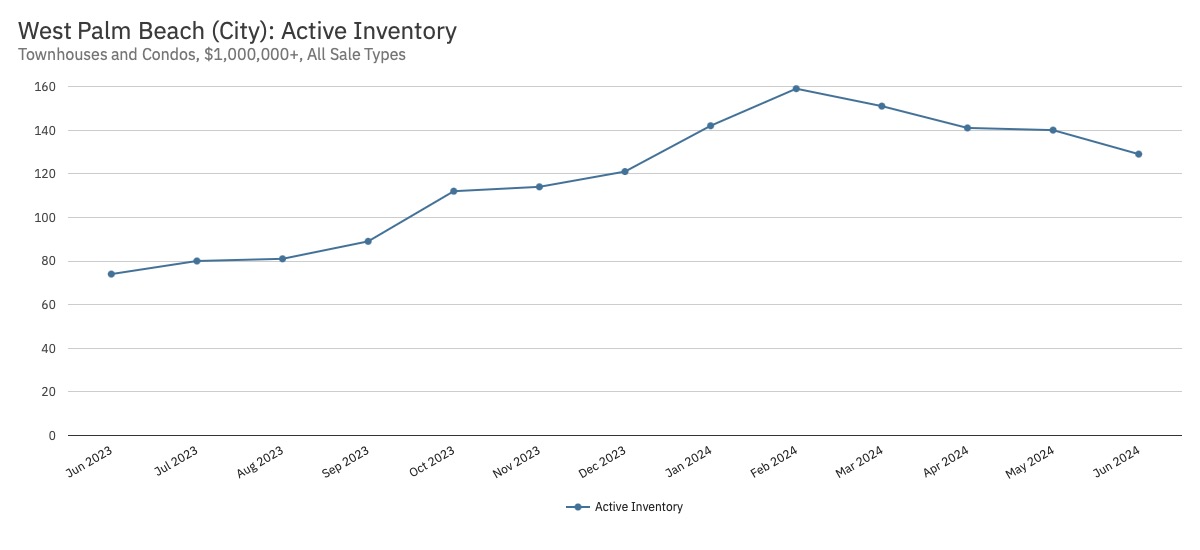

Active Inventory

Observations:

- Following national, regional, and local trends, active inventory of West Palm Beach luxury townhouses / condos is up considerably over the last year, with a recent pullback. This is reflected in both nominal listings as well as YoY change (with all of the last 12 months up from the prior year). To me, this reflects pent-up demand from luxury townhouse / condo sellers looking for the right macro and local environment to sell after a few years on the sidelines. That said, inventory was up recently by as much as nearly 100%, and this is contributing to the market softness here in West Palm Beach.

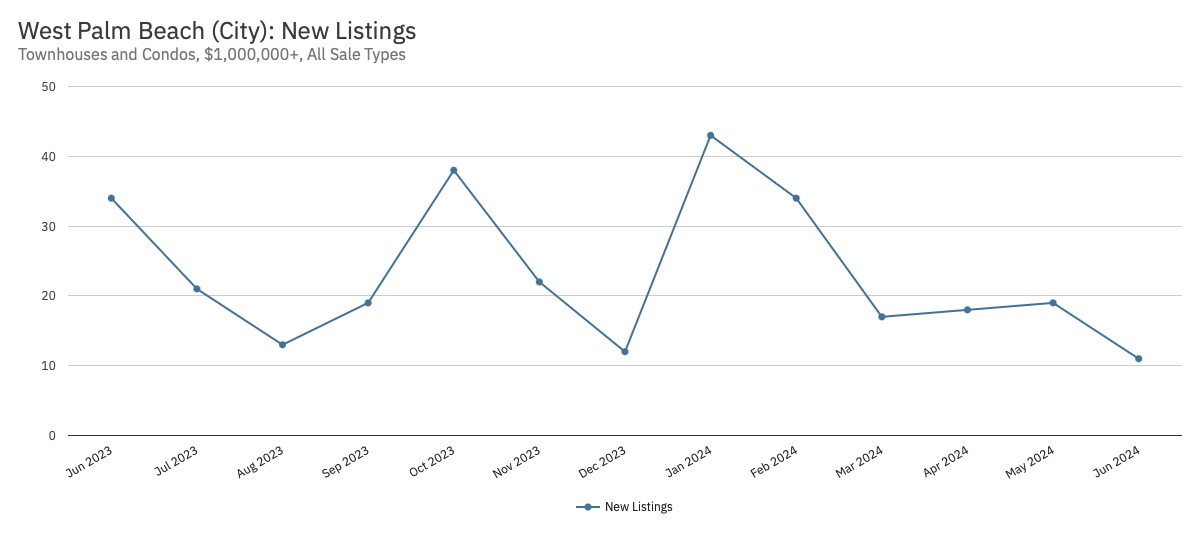

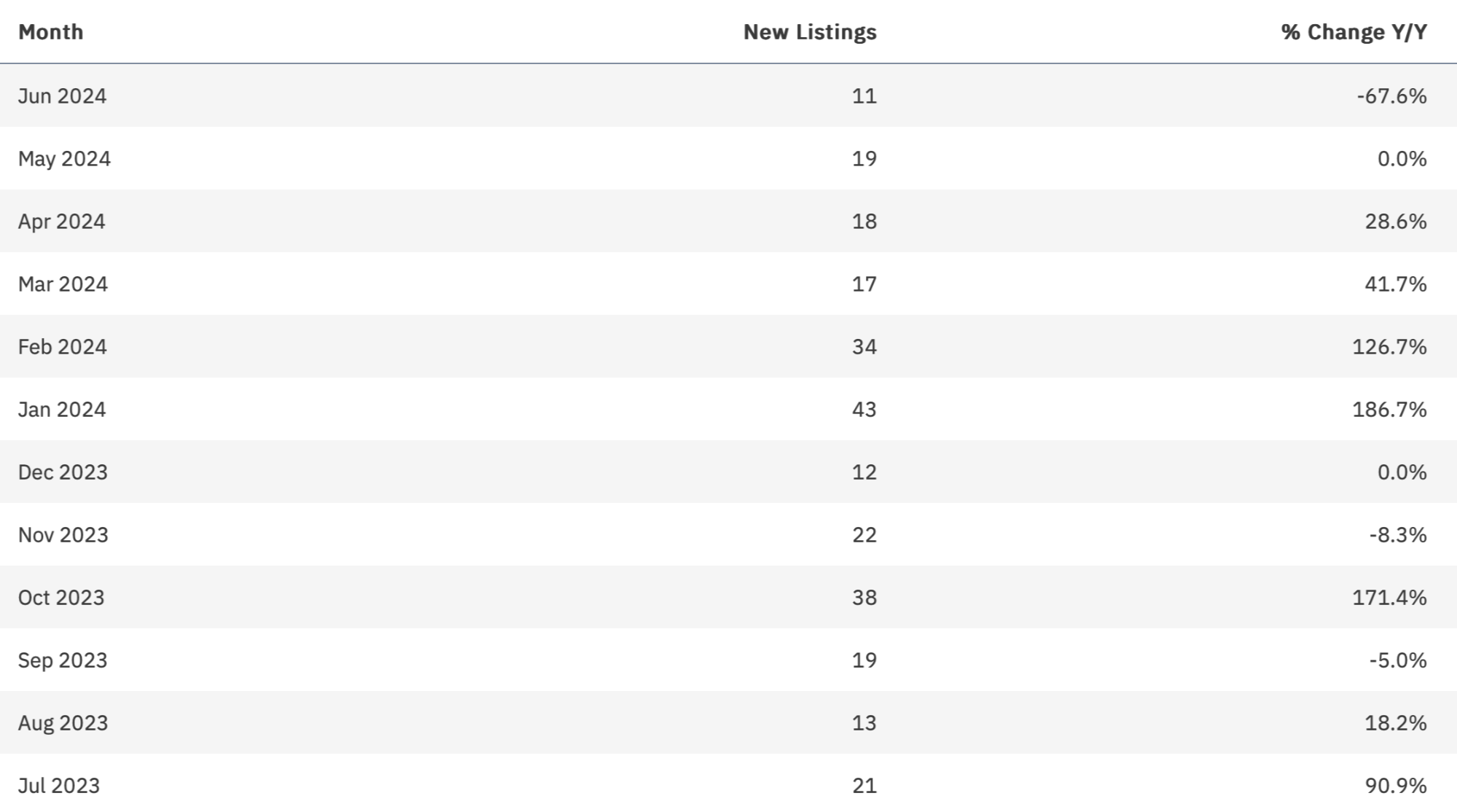

New Listings

Observations:

- Following national, regional, and local trends, new listing inventory of luxury townhouses / condos in West Palm Beach has been up for much of the last year (with 9 of the last 12 months seeing higher or flat YoY change). However, there has been a notable pullback in nominal new listings and YoY activity since January. This very well may be a reaction to the market softness we’re seeing, coupled with both data and the feeling of a slower summer season.

Months of Supply

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Following national, regional, and local trends, supply is up considerably over the last year for luxury townhouses / condos in West Palm Beach. However, there has been a pullback from highs in supply seen earlier in 2024. That said, inventory supply is down in 8 out of the last 12 months YoY, providing a rebound from a weak 2023. For this property type, the data indicates it’s certainly a buyers’ market, and I find that consistent with what I’m seeing on the ground here in West Palm Beach recently. Right now is a great time to be a buyer that's patient for opportunities.

PALM BEACH

I. Single Family Homes (SFHs)

View Available ListingsSnapshot

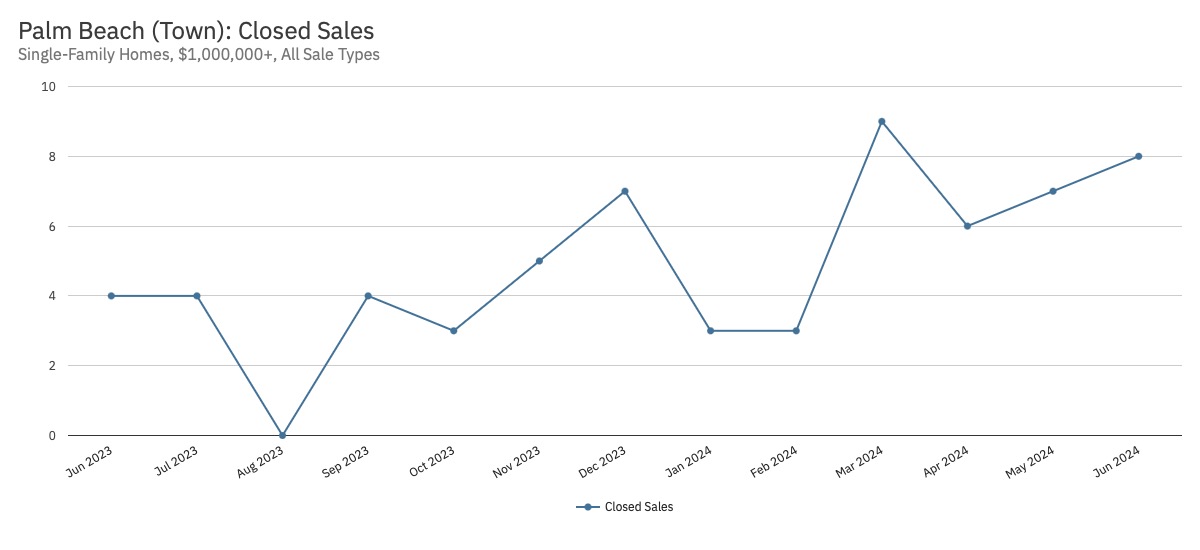

Closed Sales

Observations:

- Obviously, Palm Beach is a one-of-a-kind unicorn of a luxury SFH market, which has seen some of the biggest benefits of South Florida’s great wealth migration. Closed sales are trending up for the year, and 8 out of the last 12 months have seen YoY gains in activity.

Total Dollars Closed

Observations:

- Total dollars closed of luxury SFHs in Palm Beach have been trending up over the last year, along with some notable spikes due to large transactions. 8 out of the last 12 months have also seen YoY dollar volume gains following a cooler 2023.

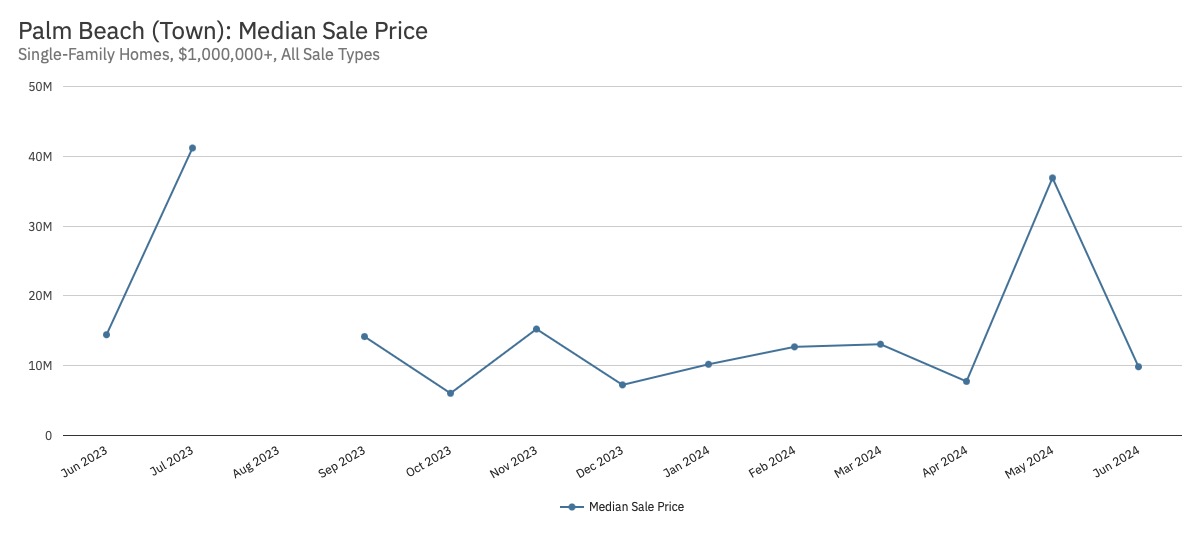

Median Sales Price

Observations:

- The median sales price for luxury SFHs in Palm Beach is a tough metric to follow generally without getting into the granular nature of the various categories of property. That said, the price has seen some bumps up along a mostly consistent trading range for much of the last year. Looking back a year demonstrates a market with an even number of up and down months in the median sales price YoY. These median sales prices lead the way in South Florida for luxury SFHs.

Median Time to Closed Sale

Observations:

- Considering the high median sales prices and large dollar transactions involved for some trophy properties, median time to closed sales in Palm Beach for luxury SFHs is among the highest in South Florida (no surprise there). However, the timeline has been trending down in 2024, and YoY change has seen seven out of the last 12 months decline in how long it takes to get to the closing table compared to the prior year.

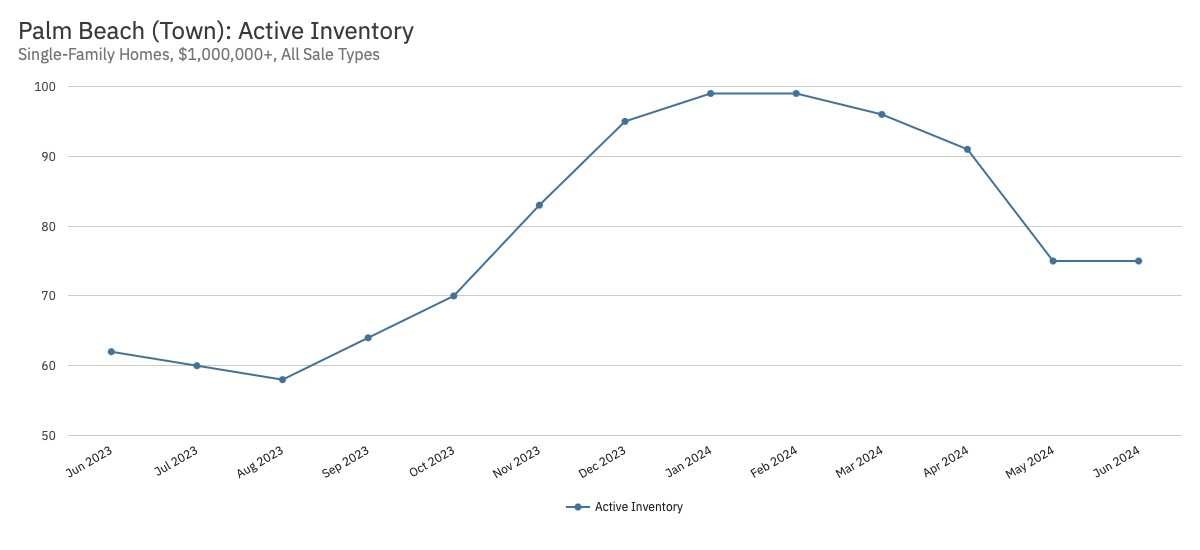

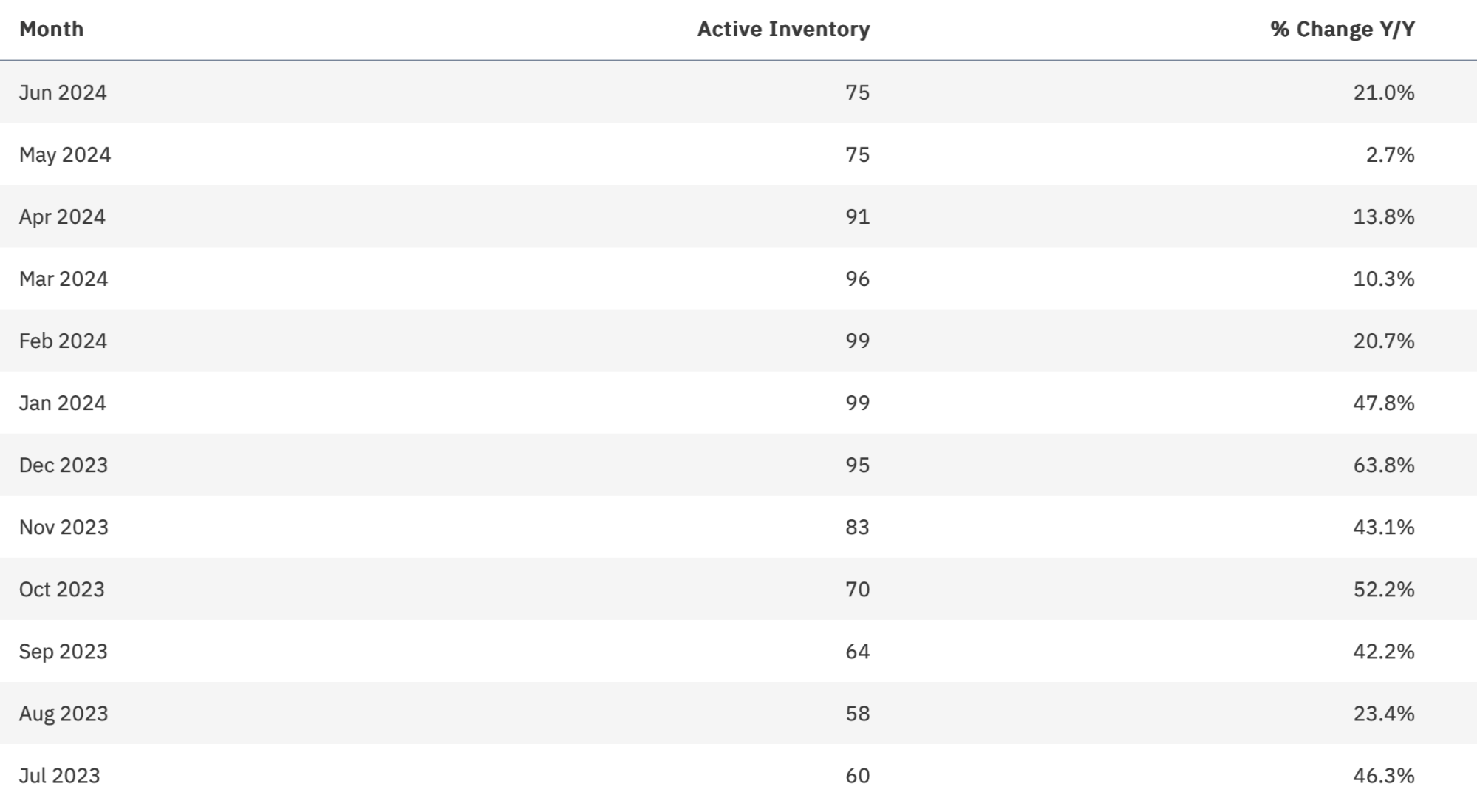

Active Inventory

Observations:

- Following national, regional, and local trends, active inventory of Palm Beach luxury SFHs is up considerably over the last year, with a recent crest and pullback so far in 2024. This is reflected in both nominal listings as well as YoY change (with all of the last 12 months up from the prior year). To me, this reflects pent-up demand from luxury SFH sellers looking for the right macro and local environment to sell after a few years on the sidelines.

New Listings

Observations:

- Following national, regional, and local trends, new listing inventory of luxury SFHs in Palm Beach has fluctuated over the last year. However, there has been a notable pullback in nominal new listings and YoY activity recently heading into the summer season. An even number of up and down months YoY have occurred over the last year as well.

Months of Supply

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Following national, regional, and local trends, supply of inventory was trending higher through January 2024 but has declined through much of this year heading into Summer. Given the upward activity in closed sales and the drop in new listings, this comes as no surprise. The data indicates it’s a buyers’ market; however, a good amount of inventory has transacted with little replacement. It’ll be interesting to see where the market goes heading into the Fall and Winter selling seasons.

II. CONDOS AND TOWNHOUSES

View Available ListingsSnapshot

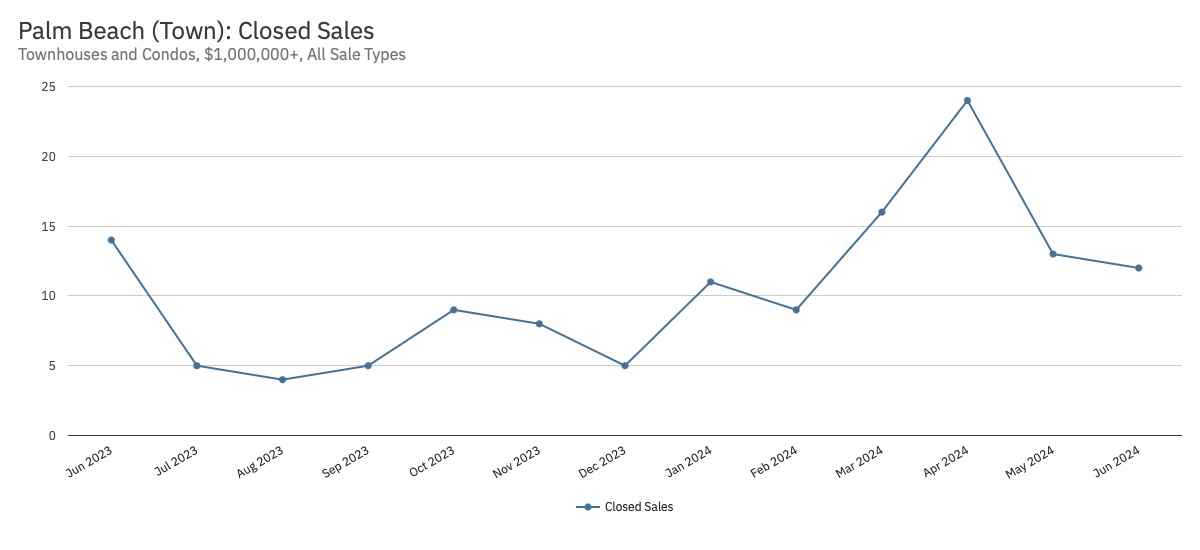

Closed Sales

Observations:

- Closed sales of luxury townhouses / condos in Palm Beach are trending up so far in 2024. However, 9 of the last 12 months are lower YoY compared to sales last year. This is a limited market compared to others for the property type in South Florida, with many units in beautiful waterfront buildings.

Total Dollars Closed

Observations:

- Consistent with the metric above, total closed sales dollars of luxury Palm Beach townhouses / condos are also trending up for the year (with momentum gaining strength from winter into spring season followed by a recent summer pullback). This sales activity is also mixed YoY, with nine of the past 12 months lower than last year.

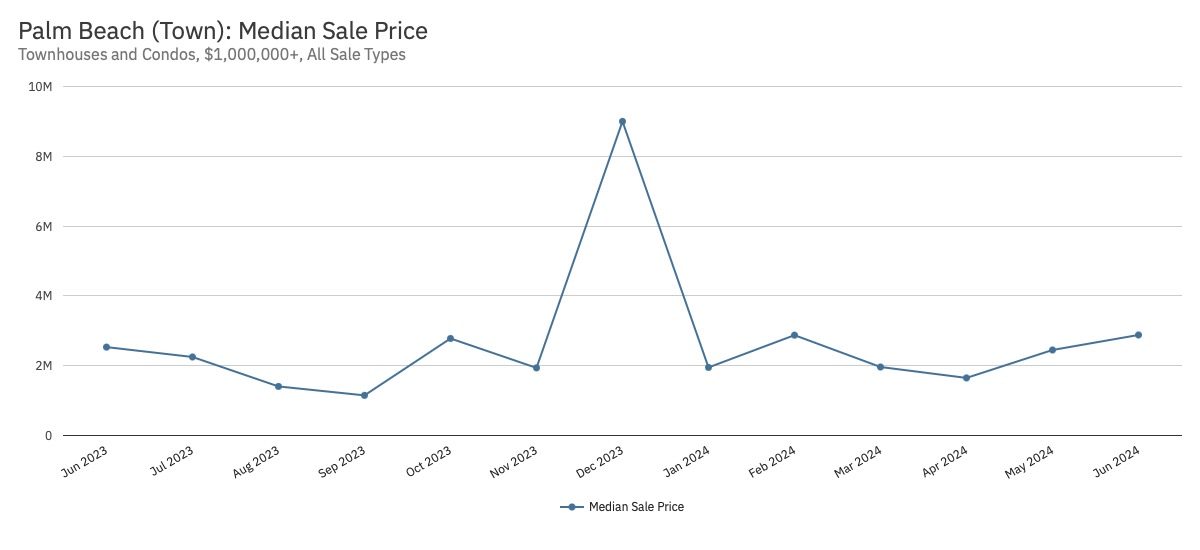

Median Sales Price

Observations:

- Median sales pricing of luxury townhouses/condos in Palm Beach has been relatively consistent and flat over the last year (except for one month with a unique transaction). YoY change has seen 7 down and5 up months for this metric. Recent median sales pricing is among the highest in South Florida.

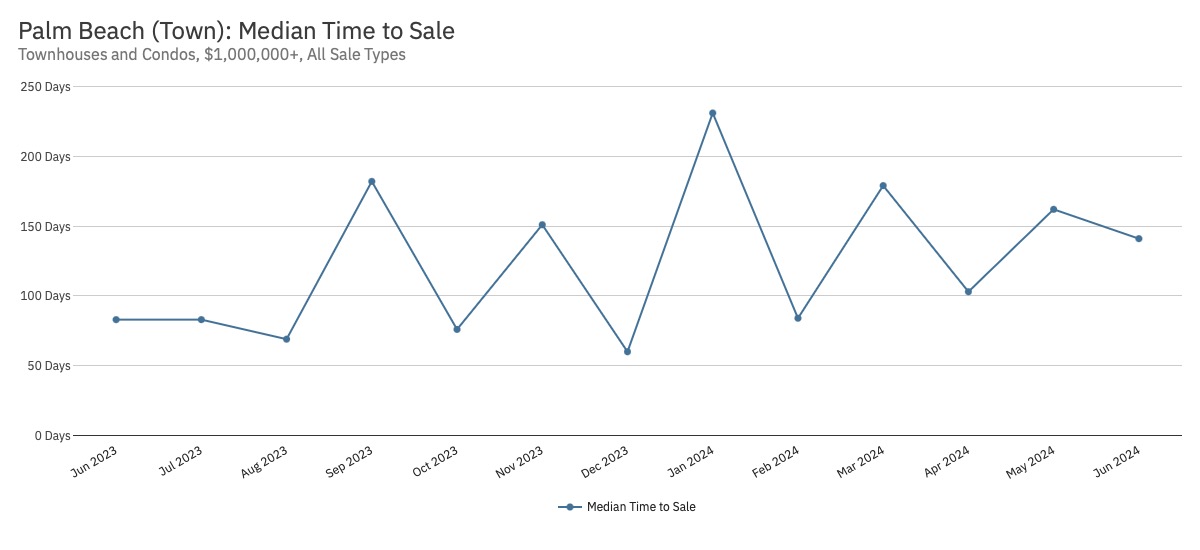

Median Time to Closed Sale

Observations:

- The median time on market to a closed sale has fluctuated greatly over the last year (with 6 months up and 6 months down YoY). Getting to the closing table for luxury townhouses / condos in Palm Beach is taking longer compared to other South Florida markets. Most luxury sellers should expect 4–6 months on the market with realistic pricing goals, which the recent median still mostly trades within.

Active Inventory

Observations:

- Following national, regional, and local trends, active inventory of Palm Beach luxury townhouses/condos is up considerably over the last year, with a recent summer pullback. This is reflected in both nominal listings as well as YoYchange (with 11 of the last 12 months up from the prior year). To me, this reflects pent-up demand from luxury townhouse / condo sellers looking for the right macro and local environment to sell after a few years on the sidelines. That said, inventory was up nearly 100% during the last year before the recent pullback.

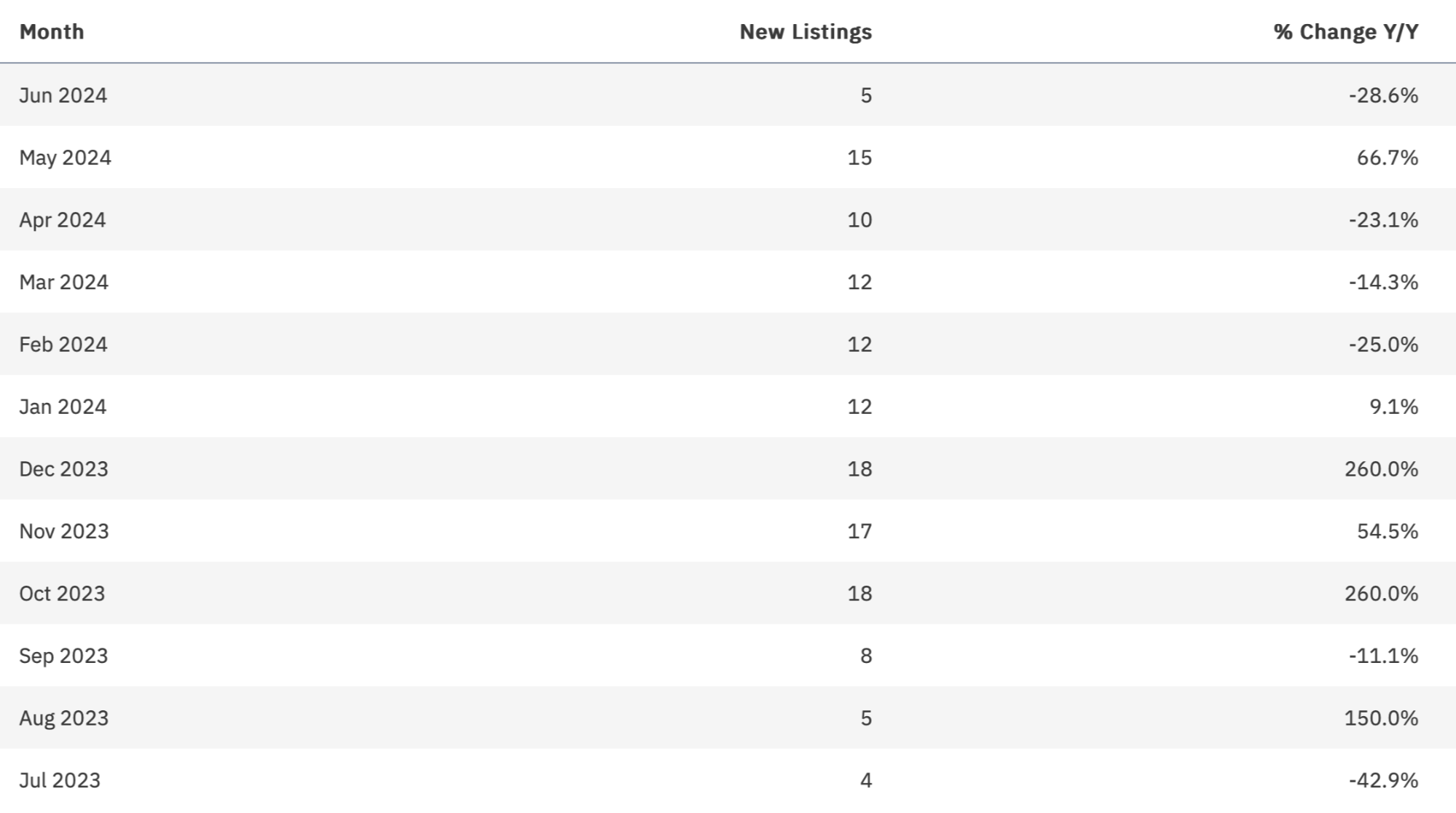

New Listings

Observations:

- Following national, regional, and local trends, new listing inventory of luxury townhouses/condos in Palm Beach had been up for much of the last year before falling from February into the summer. YoY change has seen an even number of up and down months compared to the prior year, but 4 out of the last 6 months have seen declines in new listings hitting the market.

Months of Supply

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Following national, regional, and local trends, supply is up considerably over the last year, with consistently added luxury townhouse / condo inventory YoY (all of the last 12 months are up). For this property type, the data indicates it’s certainly a buyers’ market, and I find that consistent with what I’m seeing on the ground in Palm Beach recently. Right now is a great time to be a buyer here.

DELRAY BEACH

I. Single Family Homes (SFHs)

View Available ListingsSnapshot

Closed Sales

Observations:

Observations:

- Luxury SFHs in Delray Beach have seen an increased trajectory in closed sales since the turn of the year (following a period of slight decline during the second half of 2023). Additionally, 7 out of the last 12 months have seen positive or flat gains YoY. As demand has soared for Palm Beach and South Florida luxury homes, Delray Beach has been a beneficiary of the great wealth migration, as well.

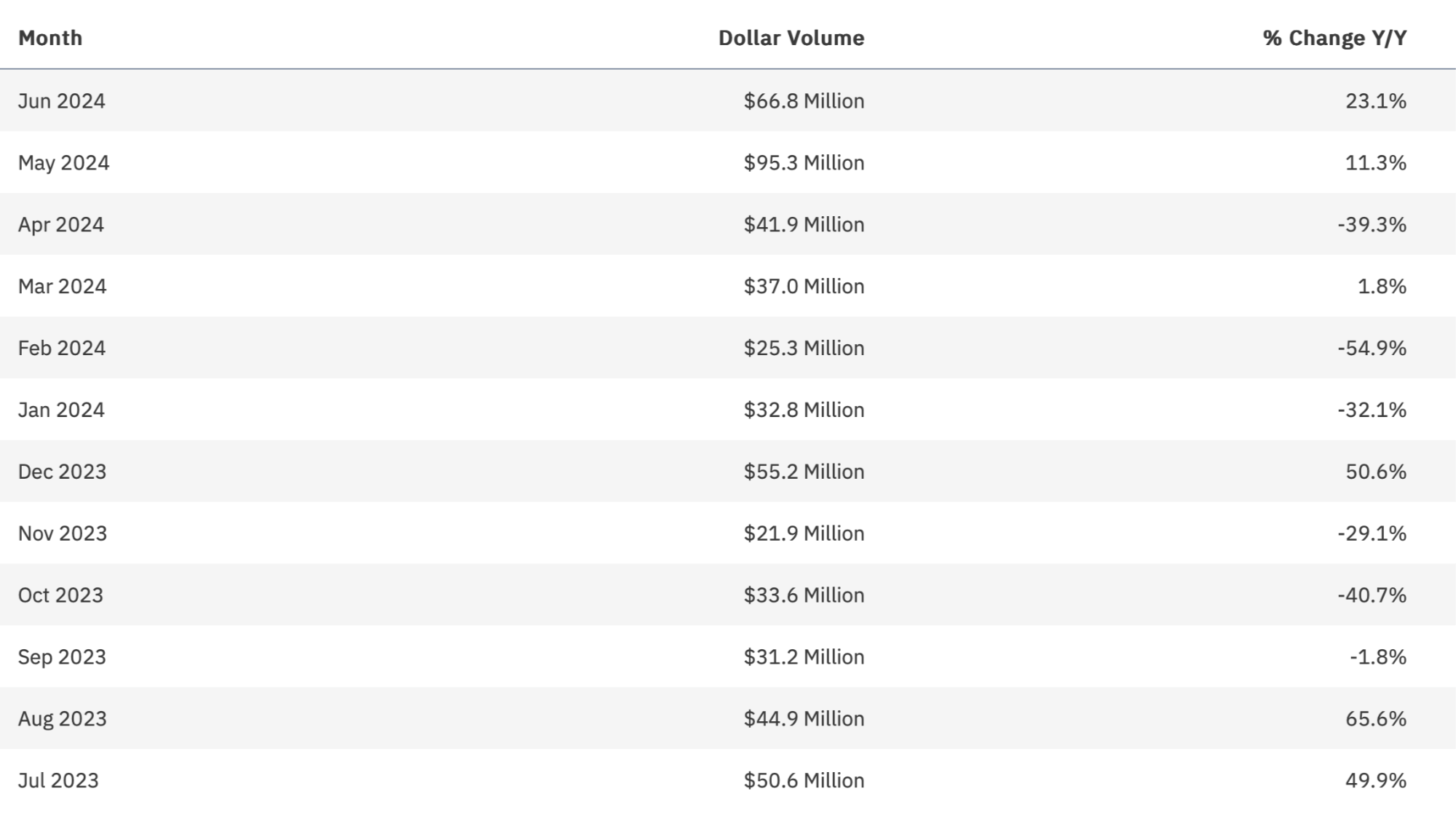

Total Dollars Closed

Observations:

- Mimicking the metric above, total dollars closed of luxury SFHs in Delray Beach have seen an increase in volume since late last year. 4 of the last 7 months have seen YoY gains compared to the prior year, as well. This data further supports the Delray Beach growth story finding another gear in 2024.

Median Sales Price

Observations:

Observations:

- The median sales price for luxury SFHs in Delray Beach has fluctuated within a consistent range over the last year, trending down from a year ago and recent highs from December. That said, 7 out of the last 12 months have also seen positive YoY change. Along with the metrics above, the data reinforces the growth story here in 2024, even with a recent summer pullback.

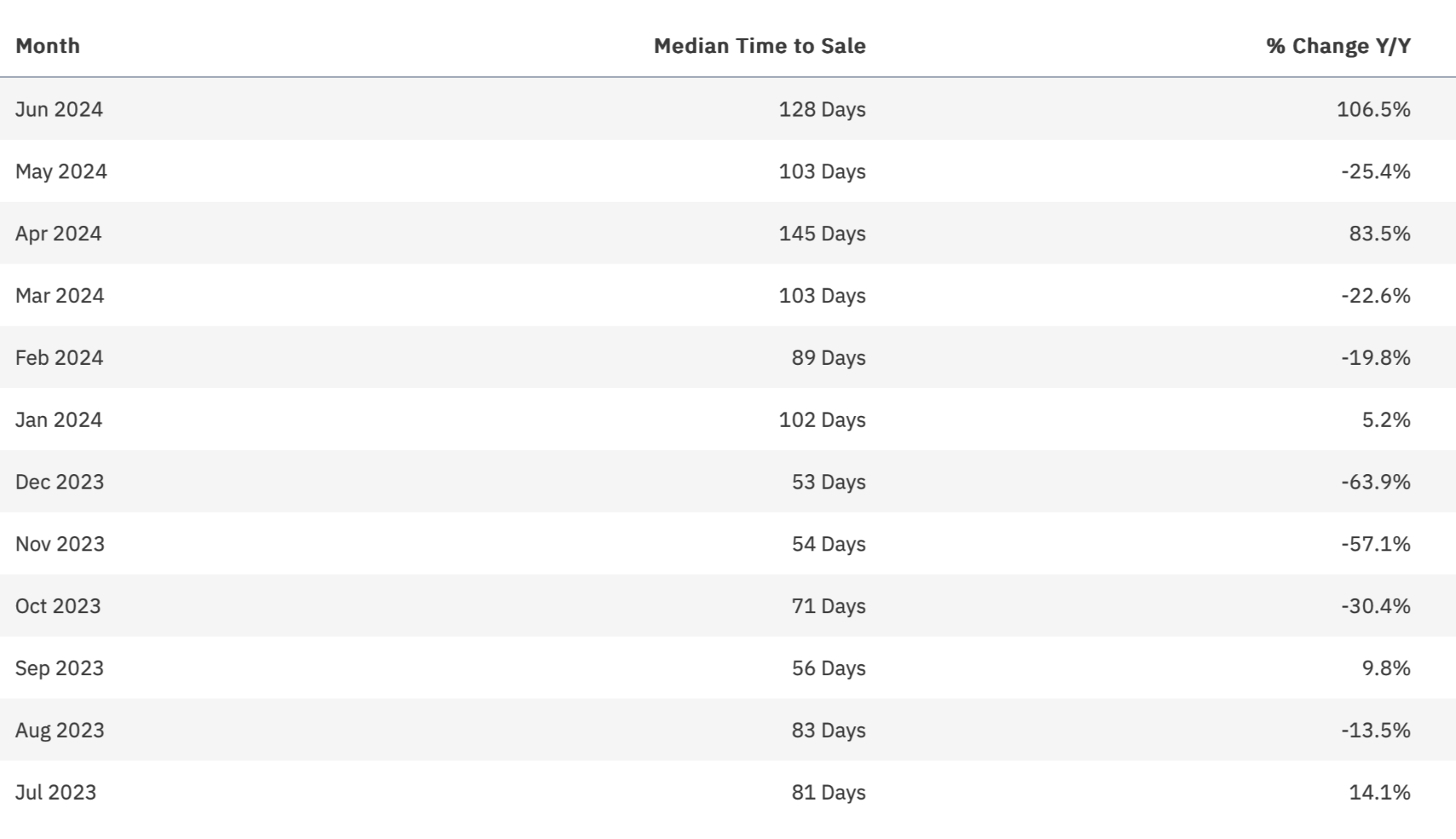

Median Time to Closed Sale

Observations:

Observations:

- The median time to closed sales of luxury SFHs in Delray Beach has been on the march higher over the last year. However, 7 out of the last 12 months have seen decreases in the time it is taking to get to the closing table YoY. The time on market is similar to other in-demand communities of South Florida and is largely within the 4–6 months most luxury sellers with realistic pricing goals should expect.

Active Inventory

Observations:

Observations:

- Contrary to national, regional, and local trends, active inventory of luxury SFHs in Delray Beach has been declining in 2024 following strong sales activity. However, all of the last 12 months have seen YoY gains in active inventory compared to the prior year. So while inventory is down, we’re still at higher levels YoY.

New Listings

Observations:

Observations:

- Contrary to national, regional, and local trends, new listing inventory of luxury SFHs in Delray Beach, although seeing upward periods of spikes, has been trending down in 2024. 7 out of the last 12 months have seen YoY gains, although 3 of the last 4 months are in decline.

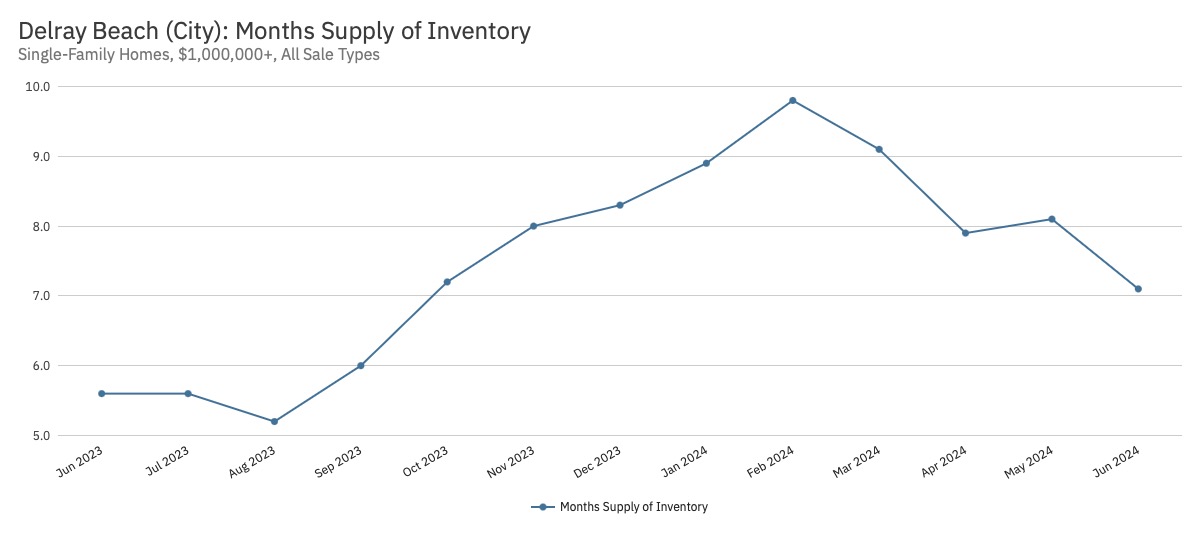

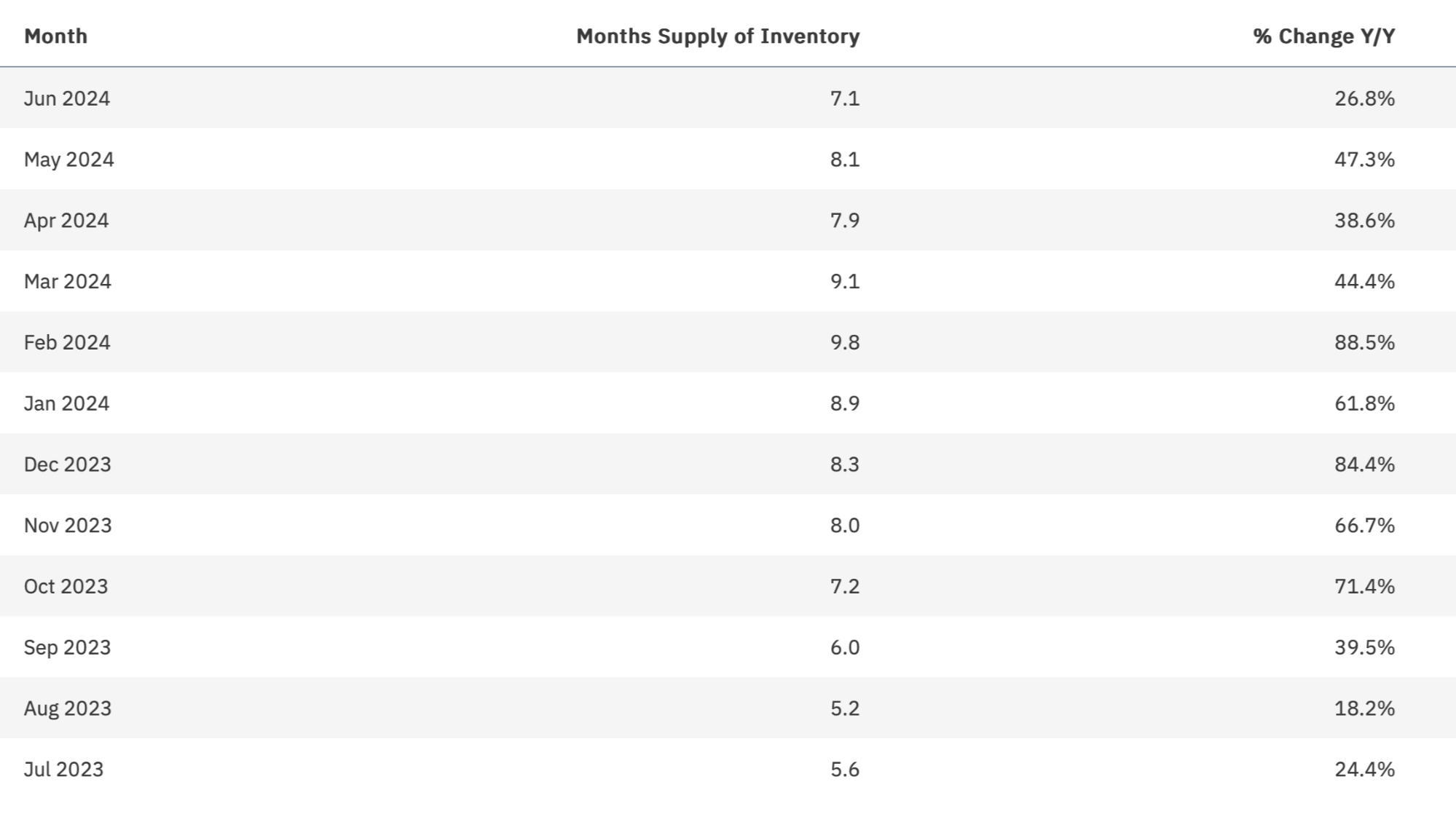

Months of Supply

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Contrary to national, regional, and local trends, supply is declining this year for Delray Beach luxury SFHs. However, YoY change has seen gains in all of the last 12 months compared to the prior year. For this property type, the data indicates it’s a neutral to buyers’ market, but deals are getting done and the market is becoming tighter on current trends. It’ll be interesting to see where the market goes heading into the fall and winter selling seasons.

II. CONDOS AND TOWNHOUSES

View Available ListingsSnapshot

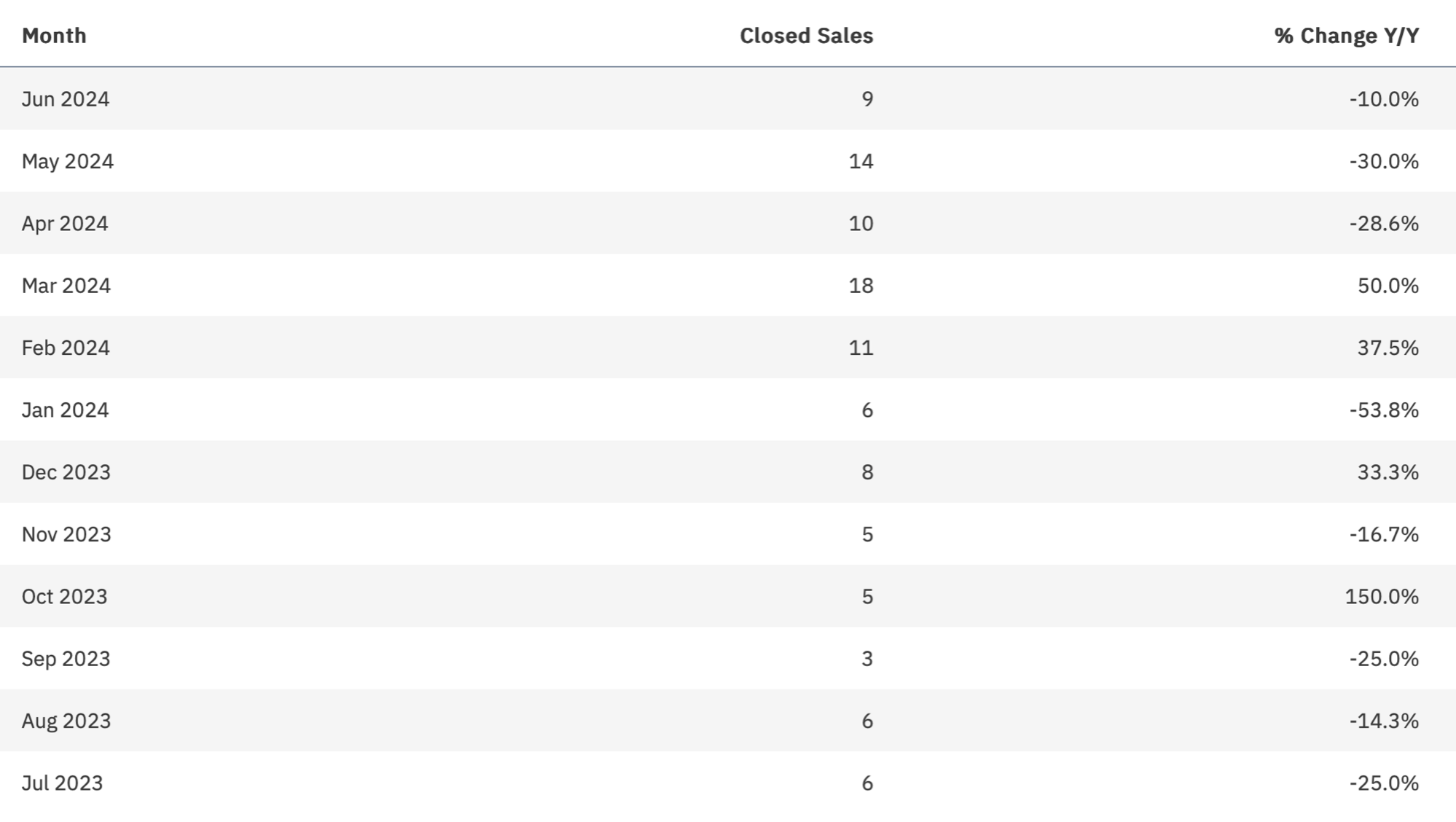

Closed Sales

Observations:

- Closed sales of Delray Beach luxury townhouses / condos have been trending up in what is a relatively limited market size; however, we’ve seen a decline in sales activity since March. 8 of the last 12 months have seen YoY declines in closed sales for luxury units here. Taken together with other metrics, there are signs of a cooling market.

Total Dollars Closed

Observations:

- Total dollars closed of Delray Beach luxury townhouses / condos have also been trending up in limited market activity this year; however, we’ve seen a decline in sales activity since March. 7 of the last 12 months have seen YoY declines in closed dollar volume for luxury units here (including three in a row), supporting the view of a cooling market.

Median Sales Price

Observations:

Observations:

- Consistent with the story of the metrics above, median sales pricing of luxury townhouses / condos in Delray Beach has been trending down since a recent high in November 2023. Generally speaking, there has been an extended period of a cooling market for this property type. Further supporting the observation, the market has seen 7 of the last 12 months down in median sales pricing YoY (with three in a row).

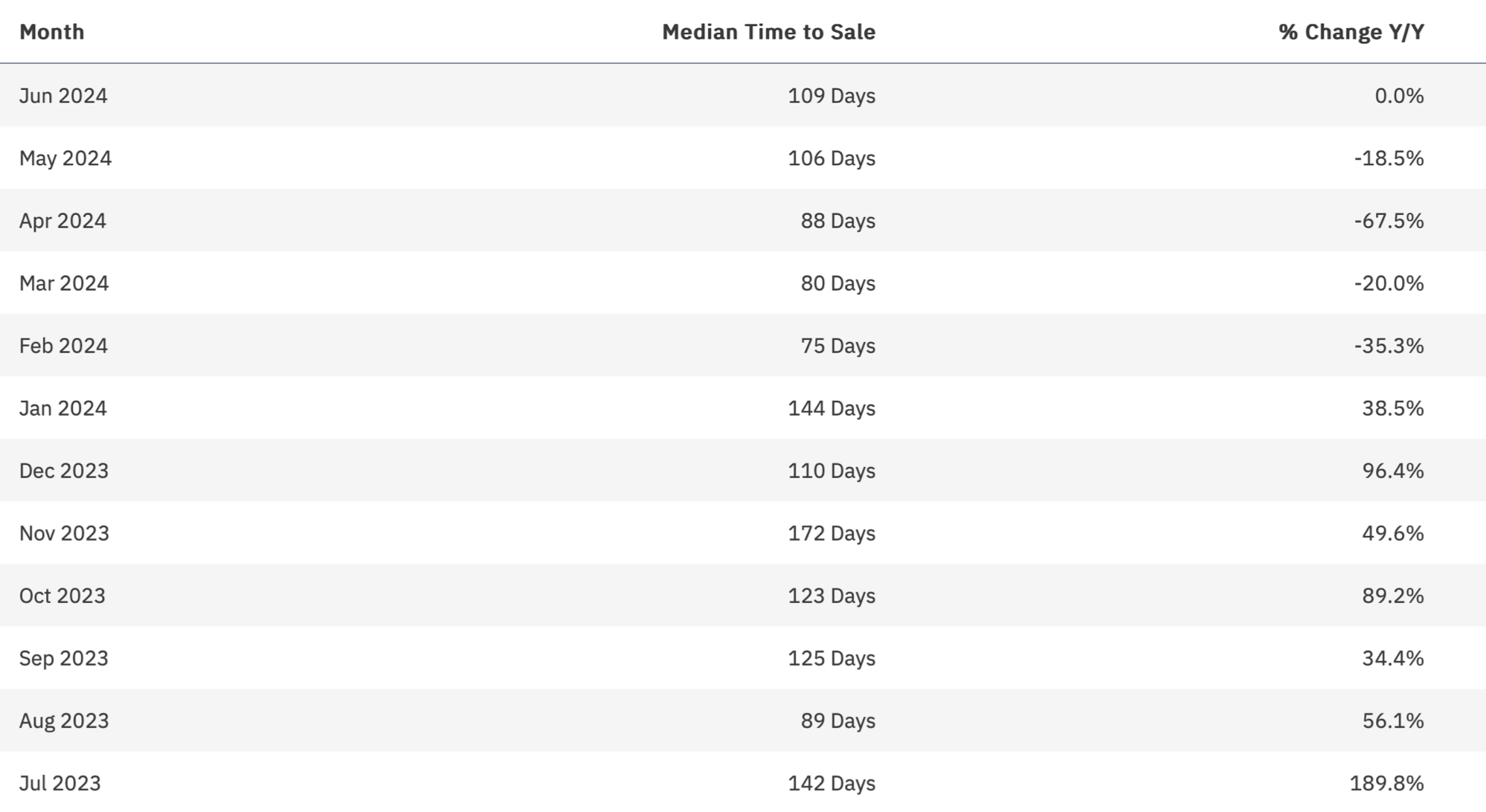

Median Time to Closed Sale

Observations:

- Median time to closed sales for luxury townhouses / condos in Delray Beach is consistent with other South Florida markets (if not on the efficient side). Most luxury sellers should expect 4–6 months to transact for this property type with realistic pricing goals. 5 months in a row are down or flat in YoY change (following 7 months of increases). Even with a cooling market, deals are getting done in efficient timelines, likely due to price adjustments.

Active Inventory

Observations:

Observations:

- Consistent with national, regional, and local trends, active inventory of luxury townhouses / condos in Delray Beach has been growing consistently (up nearly 100% from a year ago) with a slight pullback over Q2. 11 of the last 12 months have also seen YoY gains in active inventory compared to the prior year. This increase in actives is likely contributing to cooling in this property type.

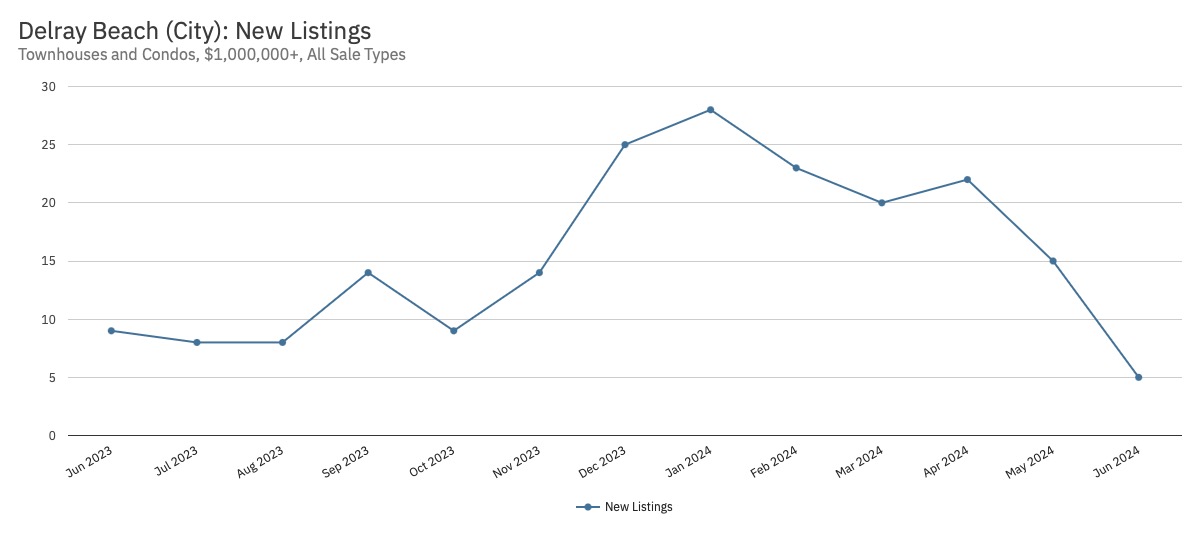

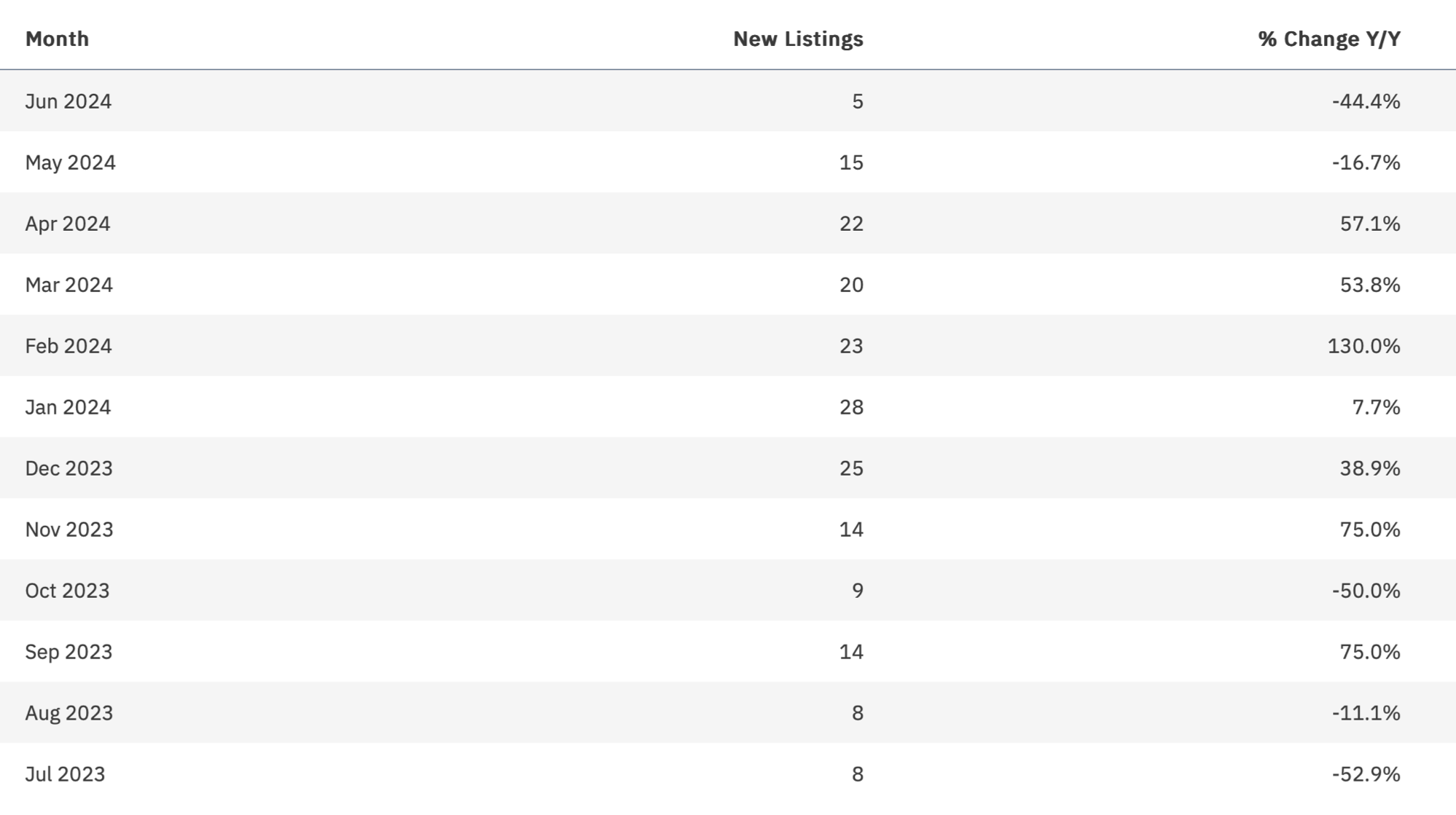

New Listings

Observations:

Observations:

- Contrary to national, regional, and local trends, new listing inventory of luxury townhouses / condos in Delray Beach has been trending down in 2024 (following a strong period of increases in the second half of 2023). 7 out of the last 12 months have seen YoY gains, although 2 of the last 4 months are in decline.

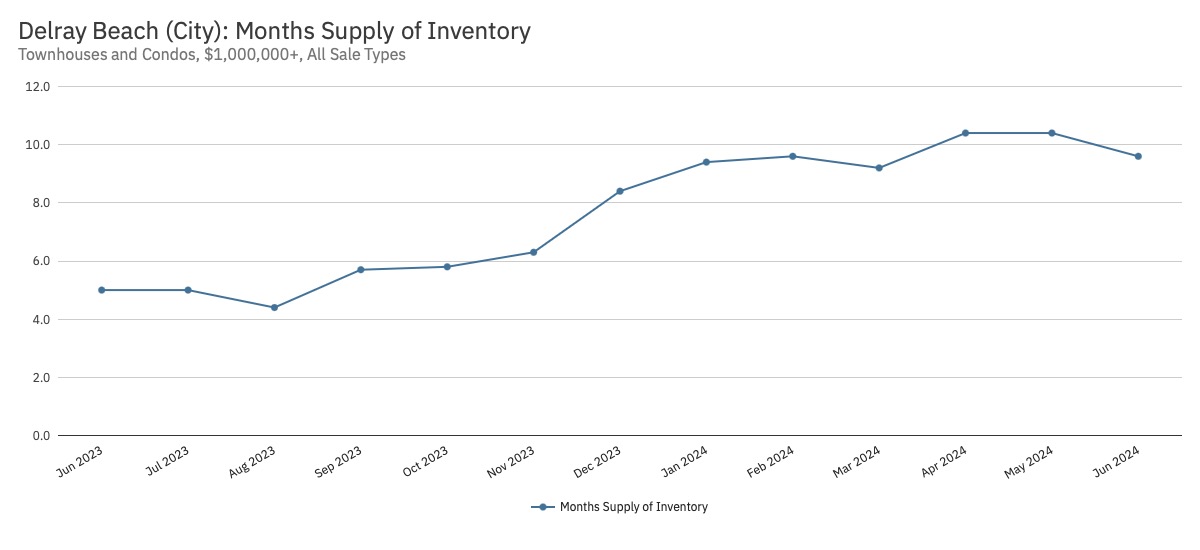

Months of Supply

Observations:

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Consistent with national, regional, and local trends, supply is growing this year for luxury townhouses / condos in Delray Beach. YoY change has seen gains in 9 of the last 12 months compared to the prior year (with 8 in a row). For this property type, the data says it’s a buyers’ market, but deals are getting done in efficient timelines due to realistic pricing. The market has been in a cooling period, which is natural compared to the tight inventory and high volume of sales over the last few years. Supply is lower for this product type compared to many areas of South Florida.

BOCA RATON

I. Single Family Homes (SFHs)

View Available ListingsSnapshot

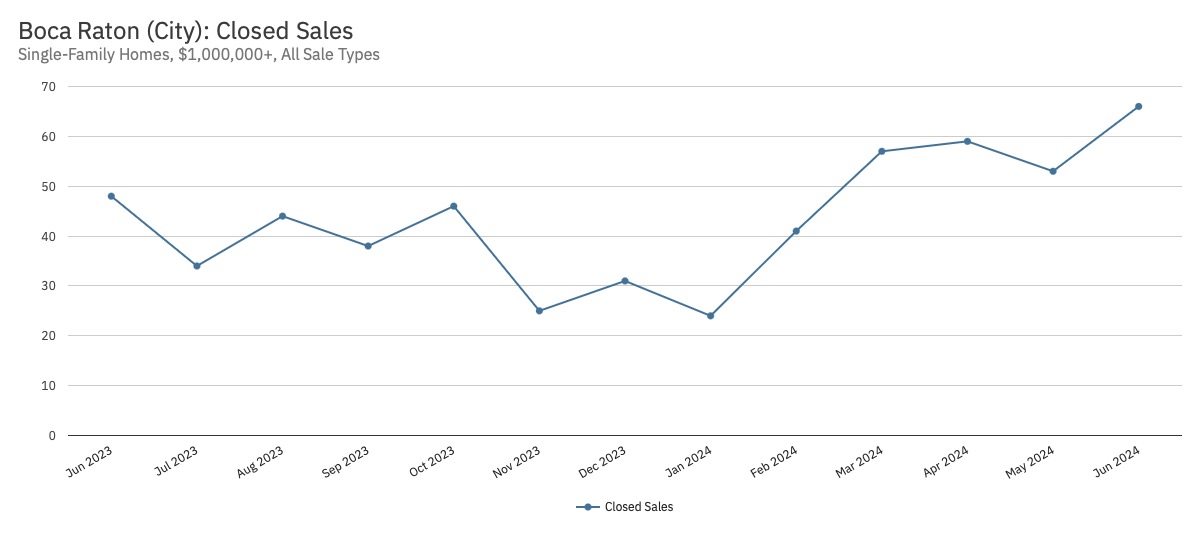

Closed Sales

Observations:

- Luxury SFHs in Boca Raton have seen an increased trajectory in closed sales since the turn of the year (following a period of slight decline during the second half of 2023). Additionally, 10 out of the last 12 months have seen positive or flat gains year-over-year (YoY). As demand has soared for Palm Beach and South Florida luxury homes, Boca Raton has been a beneficiary of the great wealth migration, as well.

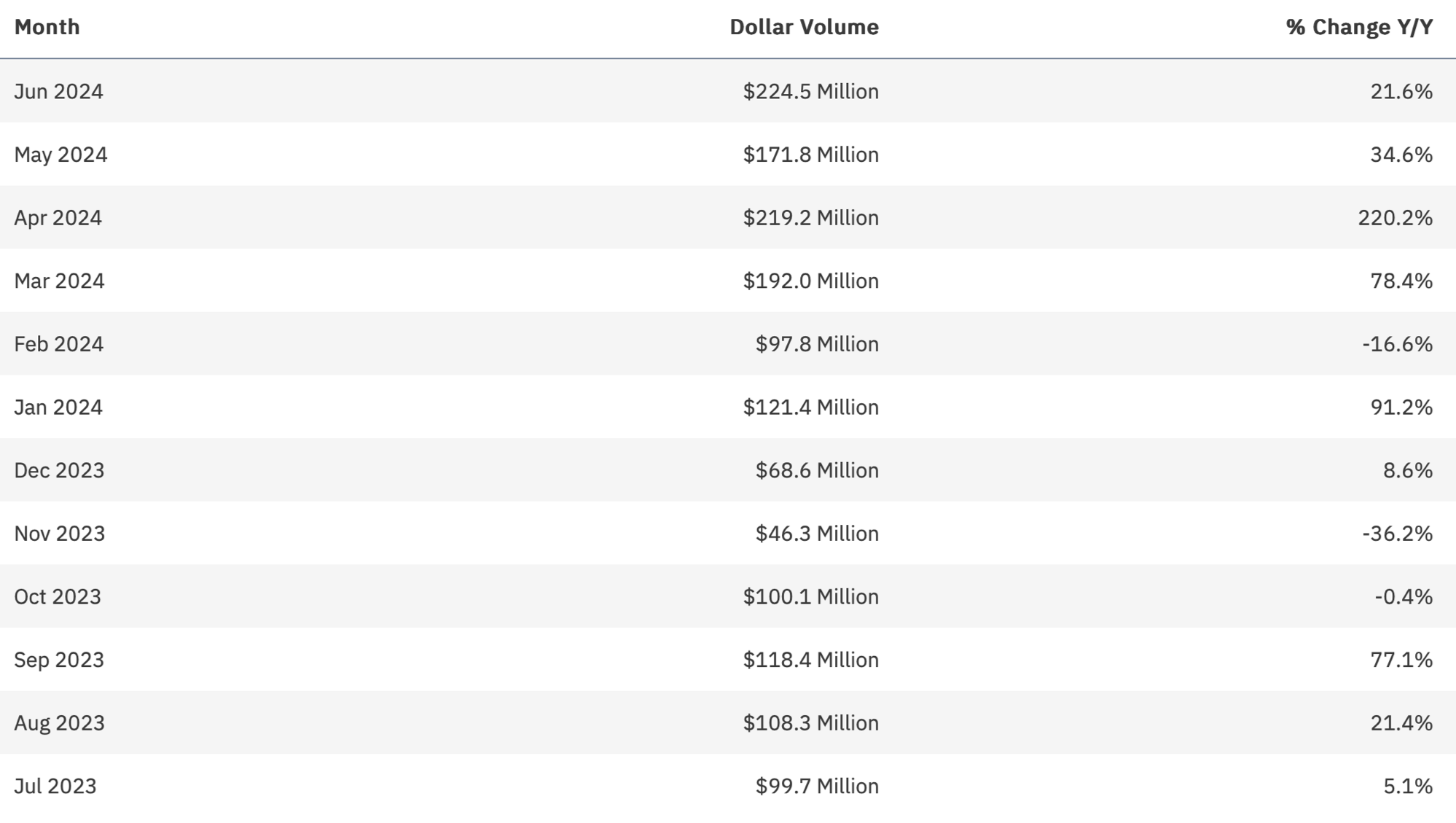

Total Dollars Closed

Observations:

- Mimicking the metric above, total dollars closed of luxury SFHs in Boca Raton have seen an increase in volume since late last year. 6 of the last 7 months have seen YoY gains compared to the prior year, as well. This data further supports the Boca Raton growth story finding top gear in 2024.

Median Sales Price

Observations:

- The median sales price for luxury SFHs in Boca Raton has been on a tremendous march up since November 2023, as one of the most in-demand markets in South Florida. Eight out of the last 12 months have also seen positive YoY change. Along with the metrics above, the data reinforces the growth story here in 2024 (including a new 12-month high set in the summer month of June).

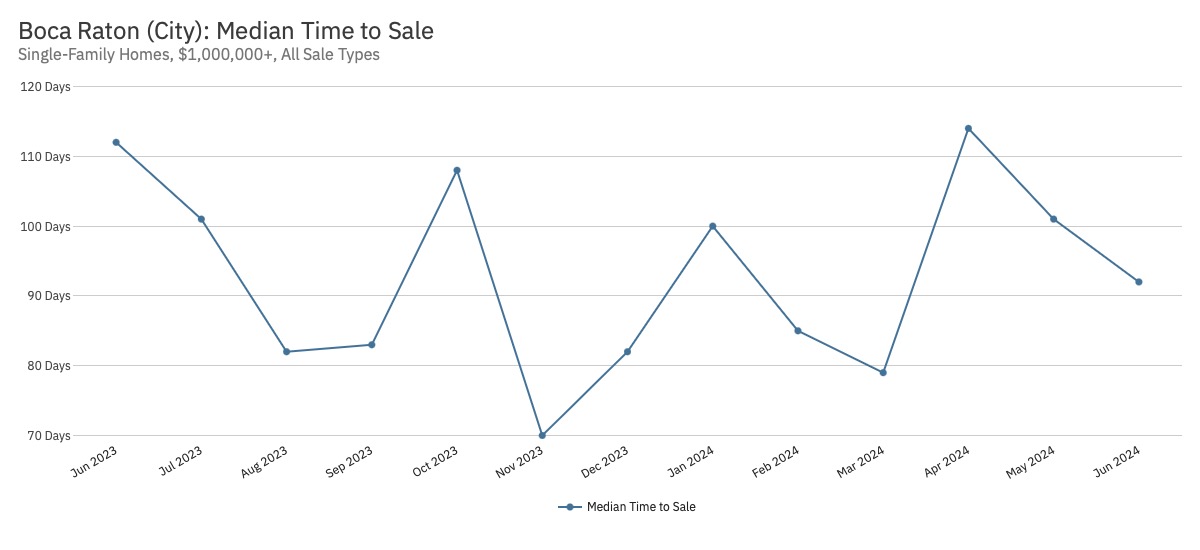

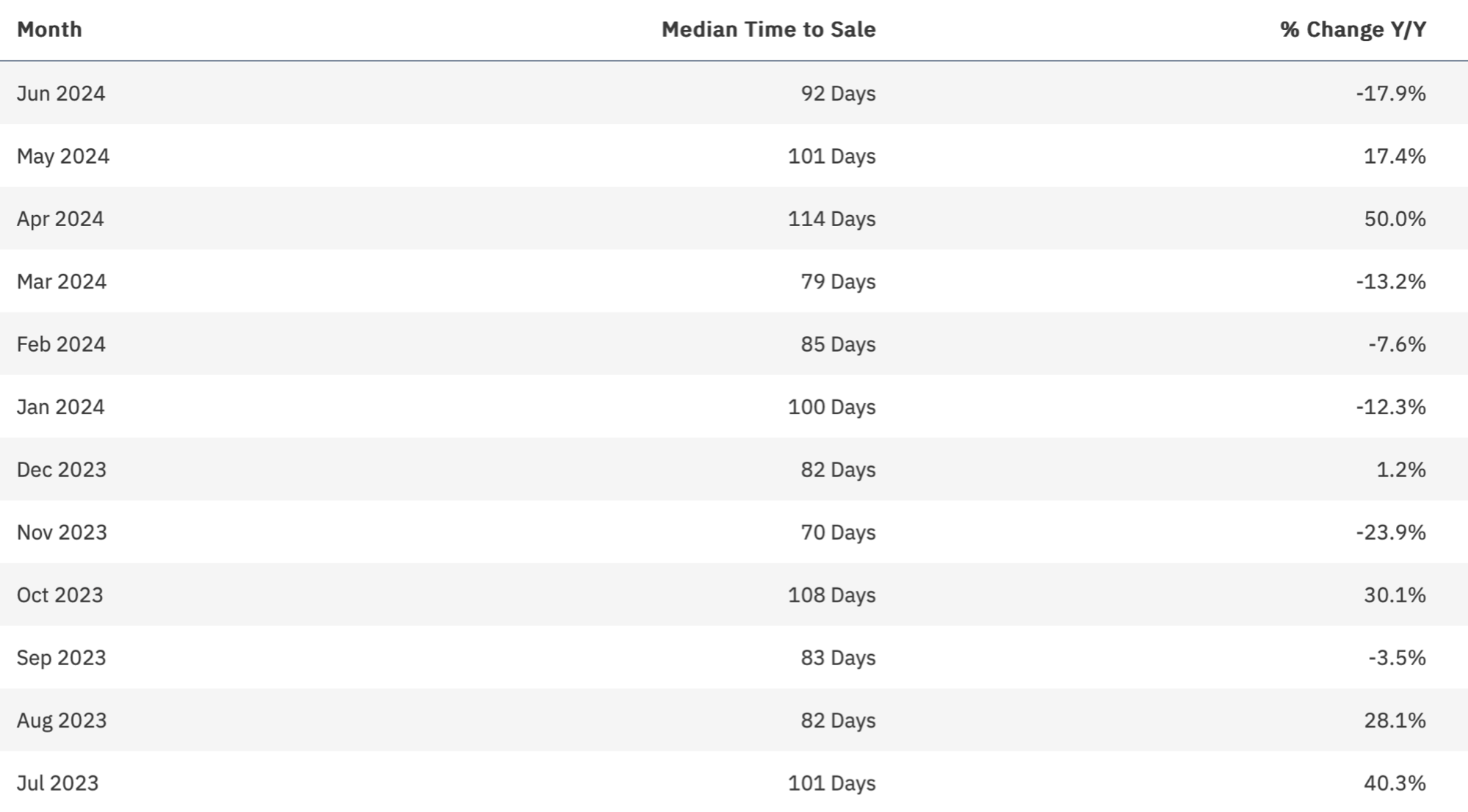

Median Time to Closed Sale

Observations:

- The median time to closed sales of luxury SFHs in Boca Raton has consistently fluctuated over the last year. 6 out of the last 12 months have seen decreases in the time it is taking to get to the closing table YoY. The time on market is similar to other in-demand communities in South Florida and is largely within the 4–6 months most luxury sellers with realistic pricing goals should expect.

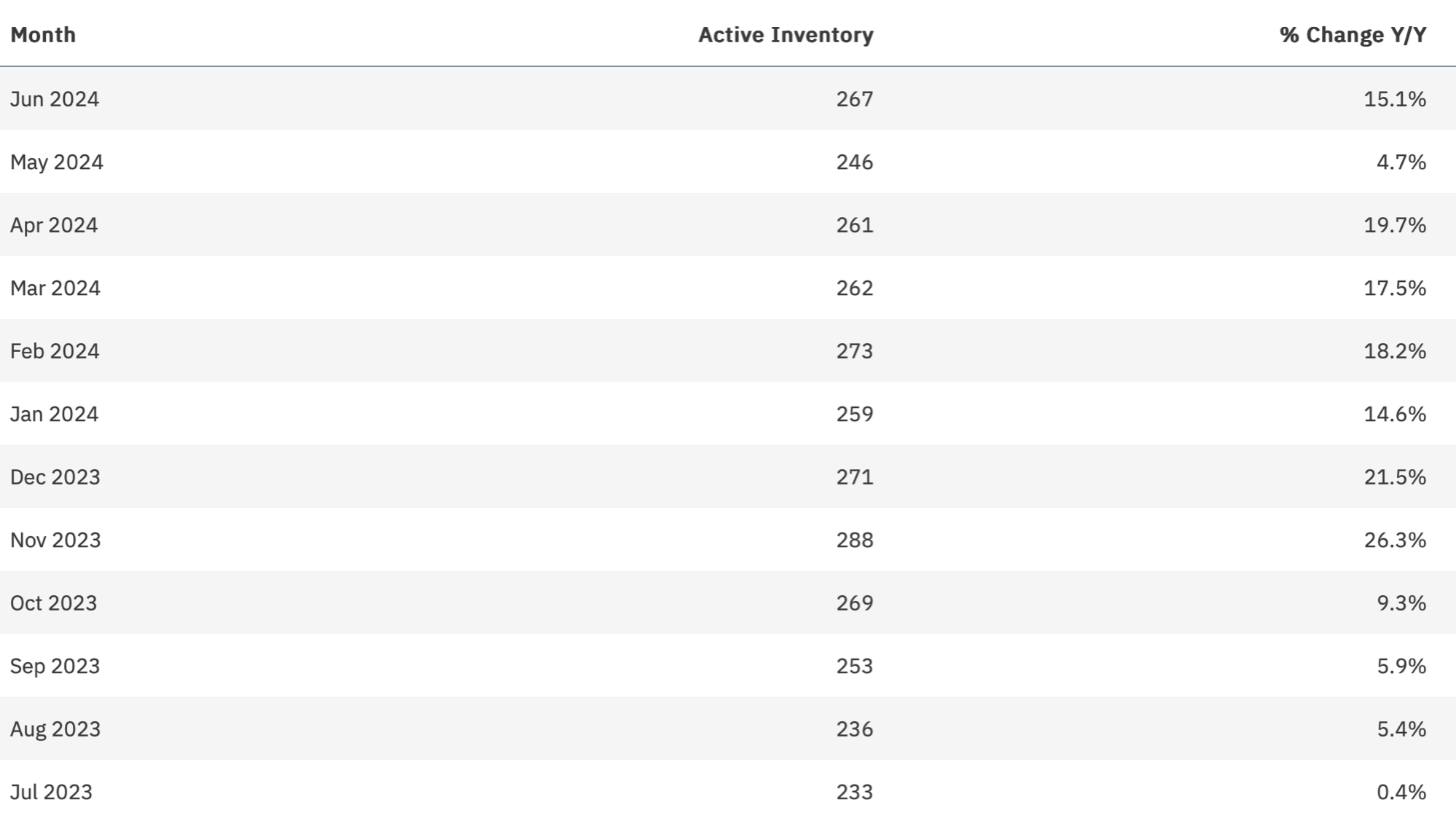

Active Inventory

Observations:

- Contrary to national, regional, and local trends, active inventory of luxury SFHs in Boca Raton has been declining since November 2023 following strong sales activity. However, all of the last 12 months have seen YoY gains in active inventory compared to the prior year. So while inventory is trending down, along with a recent uptick of actives, we’re still at higher levels YoY.

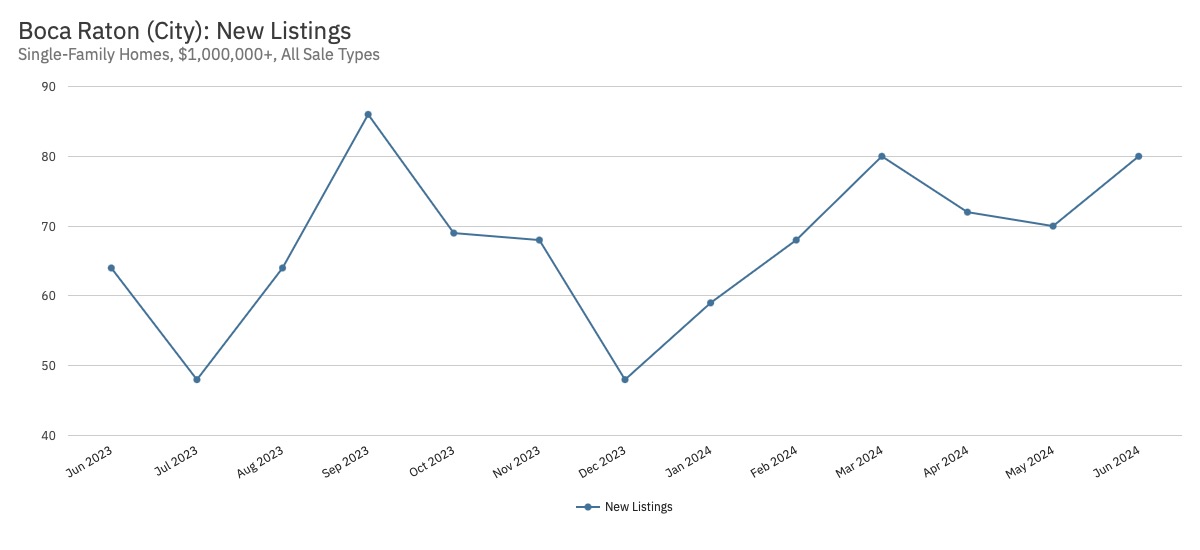

New Listings

Observations:

- Consistent with national, regional, and local trends, new listing inventory of luxury SFHs in Boca Raton has been trending up in 2024, with sellers looking to get into the hot market. 9 out of the last 12 months have seen YoY gains.

Months of Supply

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Contrary to national, regional, and local trends, supply is declining this year in Boca Raton for luxury SFHs. However, YoY change has seen gains in 7 of the last 12 months compared to the prior year. For this property type, the data says it’s technically a neutral to buyers’ market, but deals are getting done, and the market is becoming tighter on current trends (potentially heading into a seller’s market). It’ll be interesting to see where the market goes heading into the Fall and Winter selling seasons.

II. CONDOS AND TOWNHOUSES

View Available ListingsSnapshot

Closed Sales

Observations:

Observations:

- Closed sales of Boca Raton luxury townhouses / condos have been trending up in what is a relatively limited market size in South Florida. However, we’ve seen a decline in sales activity since April. Eight of the last 12 months have seen YoYgains of closed sales for luxury units here (however, the last two months are in decline).

Total Dollars Closed

Observations:

Observations:

- Total dollars closed of Boca Raton luxury townhouses / condos have also been trending up for much of the past year. However, we’ve seen a decline in sales activity since April. 10 of the last 12 months have seen YoY gains of closed dollar volume for luxury units here, supporting the view of a hot market that is entering a natural pullback.

Median Sales Price

Observations:

Observations:

- The median sales pricing of luxury townhouses / condos in Boca Raton has been fluctuating greatly over the last year. Seven months have seen YoY gains, with 5 months in decline. Median sales pricing at the end of Q2 2024 is just above the mark for the same period last year.

Median Time to Closed Sale

Observations:

- Median time to closed sales for luxury townhouses / condos in Boca Raton is consistent with other South Florida markets (if not slightly faster). Most luxury sellers should expect 4–6 months to transact for this product type with realistic pricing goals. 8 out of the last 12 months have seen increases in the YoY time it takes to get to the closing table (with the last 2 months in decline).

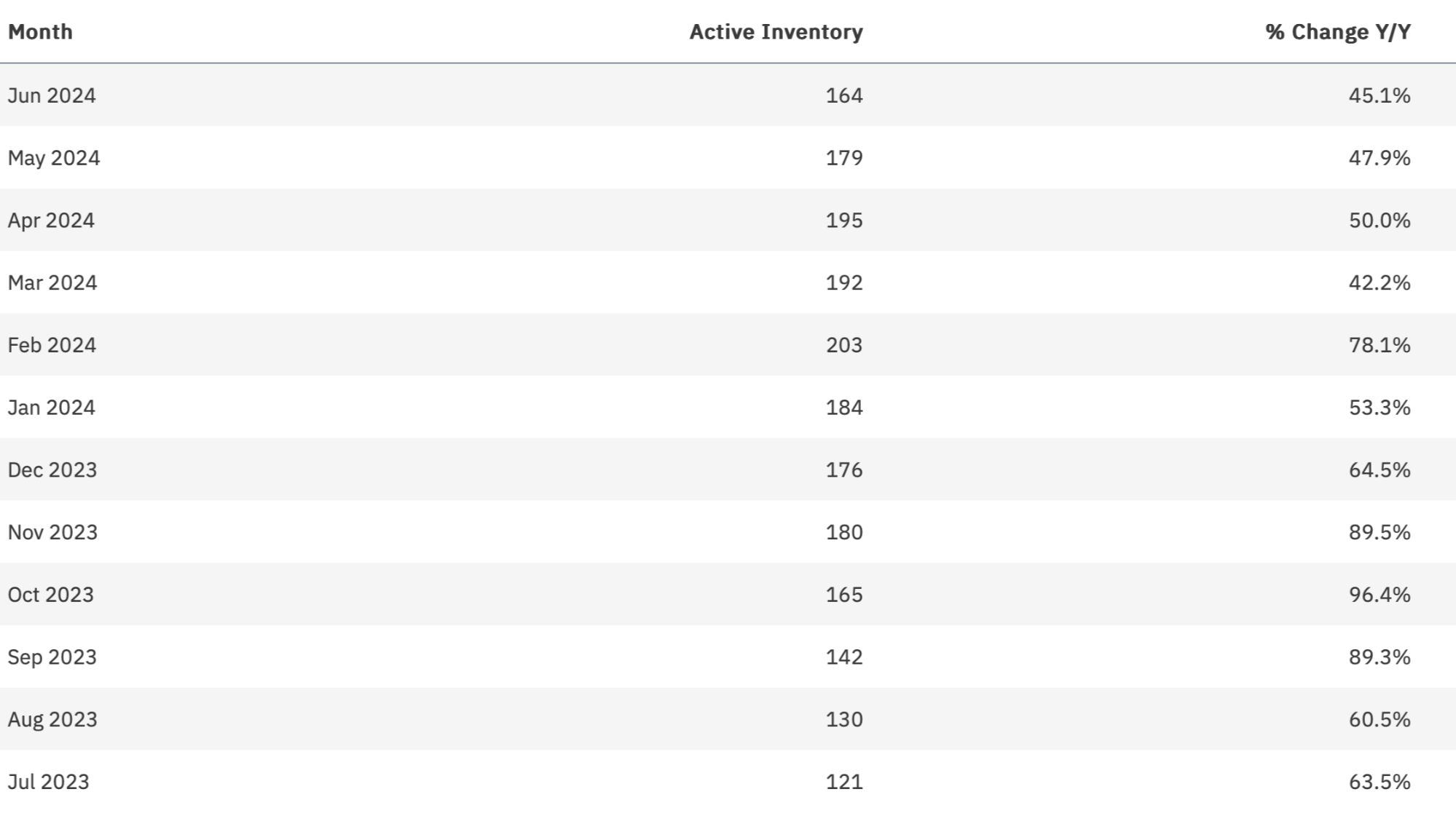

Active Inventory

Observations:

- Consistent with national, regional, and local trends, active inventory of luxury townhouses/condos in Boca Raton has been growing consistently, with a pullback over Q2. All of the last 12 months have also seen YoY gains in active inventory compared to the prior year. There’s no doubt that sellers are looking to get into the hot market for this property type.

New Listings

Observations:

- Contrary to national, regional, and local trends, new listing inventory of luxury townhouses / condos in Boca Raton has been trending down in 2024 (following a strong period of increases in the second half of 2023). Ten out of the last 12 months have seen YoY gains in new listing inventory.

Months of Supply

Observations:

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Contrary to national, regional, and local trends, supply is declining this year in Boca Raton for luxury townhouses / condos after hitting a recent peak in February 2024. However, YoY change has seen gains in all of the last 12 months compared to the prior year (albeit notably lower gains since November 2023). For this property type, the data says it’s technically a buyers’ market, but deals are getting done, and the market is becoming tighter on current trends. It’ll be interesting to see where the market goes heading into the fall and winter selling seasons.

ALL PALM BEACH (COUNTY)

I. Single Family Homes (SFHs)

View Available ListingsSnapshot

Closed Sales

Observations:

Observations:

- Luxury SFHs in Palm Beach (county) have seen an increased trajectory in closed sales since the turn of the year (following a period of decline during the second half of 2023). Additionally, 12 out of the last 12 months have seen positive gains YoY. As demand has soared for South Florida luxury homes, Palm Beach has specifically been a beneficiary of the great wealth migration.

Total Dollars Closed

Observations:

- Mimicking the metric above, total dollars closed of luxury SFHs in Palm Beach have seen an increase in volume since late last year. 10 of the last 12 months have seen YoY gains compared to the prior year as well (including eight in a row). The last four months have seen dollar volume soar to $900M–$1B+, setting 12-month highs in the process. This data further supports the Palm Beach growth story finding another gear in 2024.

Median Sales Price

Observations:

Observations:

- The median sales price for luxury SFHs in Palm Beach has been on a climb since November 2023, with a recent pullback as one of the most in-demand markets in South Florida. That said, 7 out of the last 12 months have seen slight negative YoY change. Along with the metrics above, the data reinforces the growth story here in 2024.

Median Time to Closed Sale

Observations:

- The median time to closed sales of luxury SFHs in Palm Beach has been on the rise since November 2023, following a long period of decline. 7 out of the last 12 months have seen increases in the time it is taking to get to the closing table YoY. The time on market is similar to other in-demand communities of South Florida and is largely within the 4–6 months most luxury sellers with realistic pricing goals should expect.

Active Inventory

Observations:

Observations:

- Consistent with national, regional, and local trends, active inventory of luxury SFHs in Palm Beach has been rising steadily since the summer of 2023. All of the last 12 months have seen YoY gains in active inventory compared to the prior year. There’s no doubt increased inventory is due to pent-up seller demand from the last few years coupled with those looking to get into the hot market.

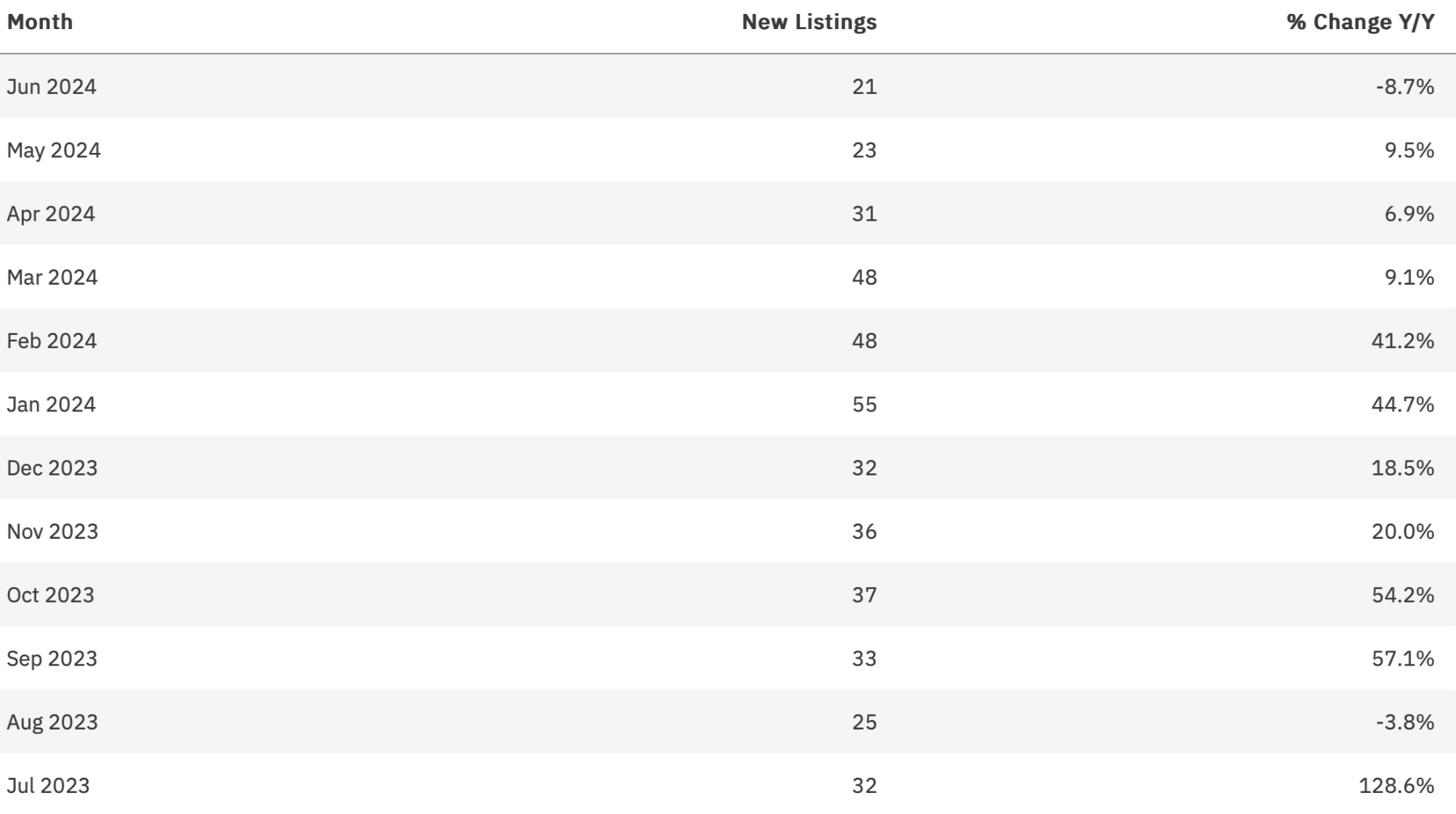

New Listings

Observations:

Observations:

- Contrary to national, regional, and local trends, new listing inventory of luxury SFHs in Palm Beach has been declining this year. However, 10 of the last 12 months have seen YoY gains in new listing inventory compared to the prior year. This metric is contributing to market tightening and the median sales pricing we’re seeing.

Months of Supply

Observations:

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Contrary to national, regional, and local trends, supply is declining this year in Palm Beach (county) for luxury SFHs. However, YoY change has seen gains in all of the last 12 months compared to the prior year. For this property type, the data says it’s technically a neutral to buyers’ market, but deals are getting done and the market is becoming tighter on current trends (potentially heading into a seller’s market). It’ll be interesting to see where the market goes heading into Fall and Winter selling seasons.

II. CONDOS AND TOWNHOUSES

View Available ListingsSnapshot

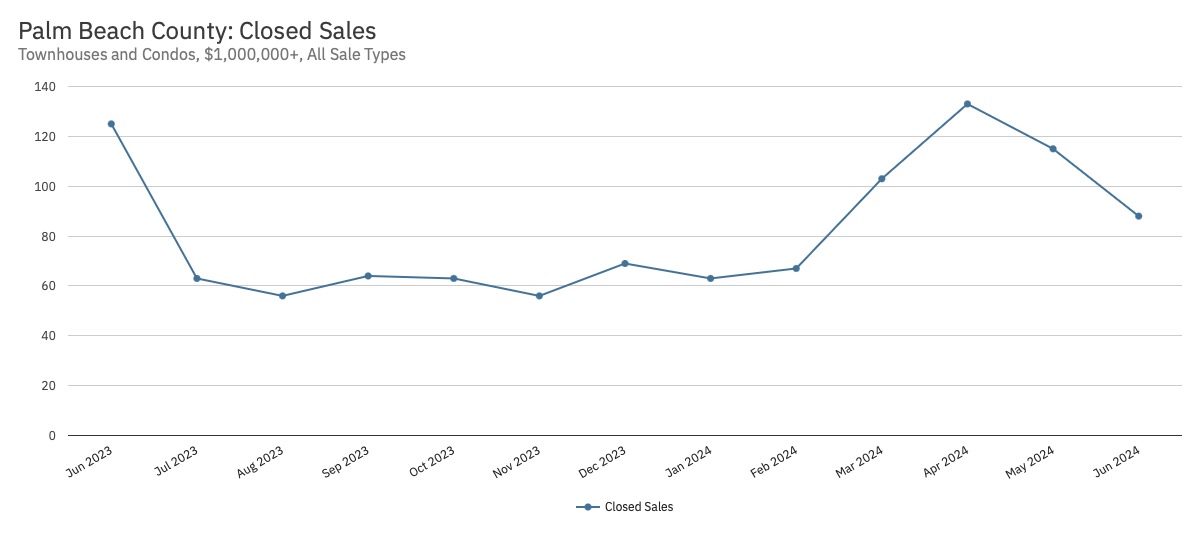

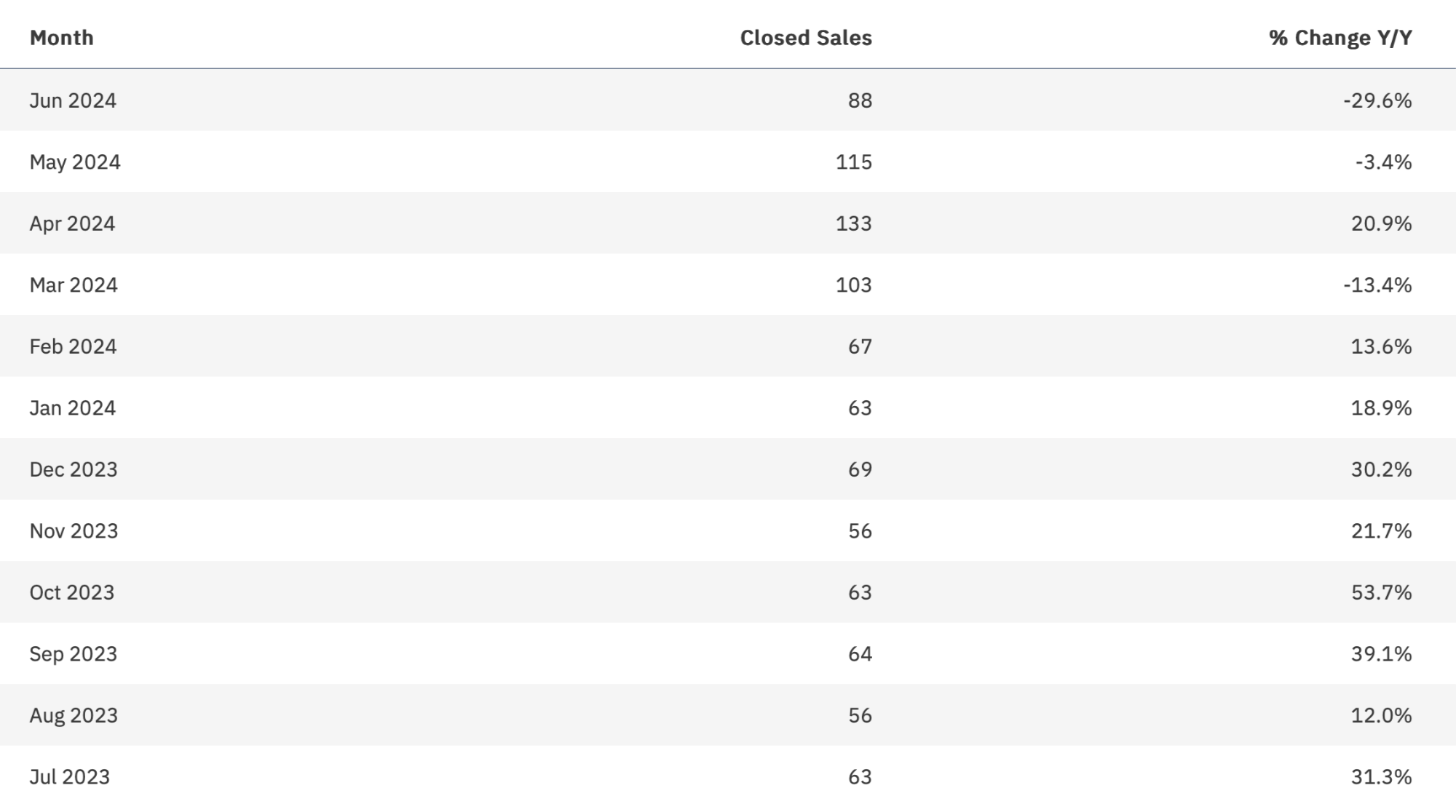

Closed Sales

Observations:

- Closed sales of Palm Beach (county) luxury townhouses / condos have been trending up in what is a relatively limited market size (comparably) in South Florida; however, we’ve seen a decline in sales activity since April. 9 of the last 12 months have seen YoY gains in closed sales for luxury units here; however, 3 out of the last 4 months are in decline.

Total Dollars Closed

Observations:

Observations:

- Total dollars closed of Palm Beach luxury townhouses / condos have also been trending up for much of the past year; however, similarly, we’ve seen a decline in sales activity since April. 8 of the last 12 months have seen YoY gains in closed dollar volume for luxury units here, although 4 out of the last 5 months are in decline.

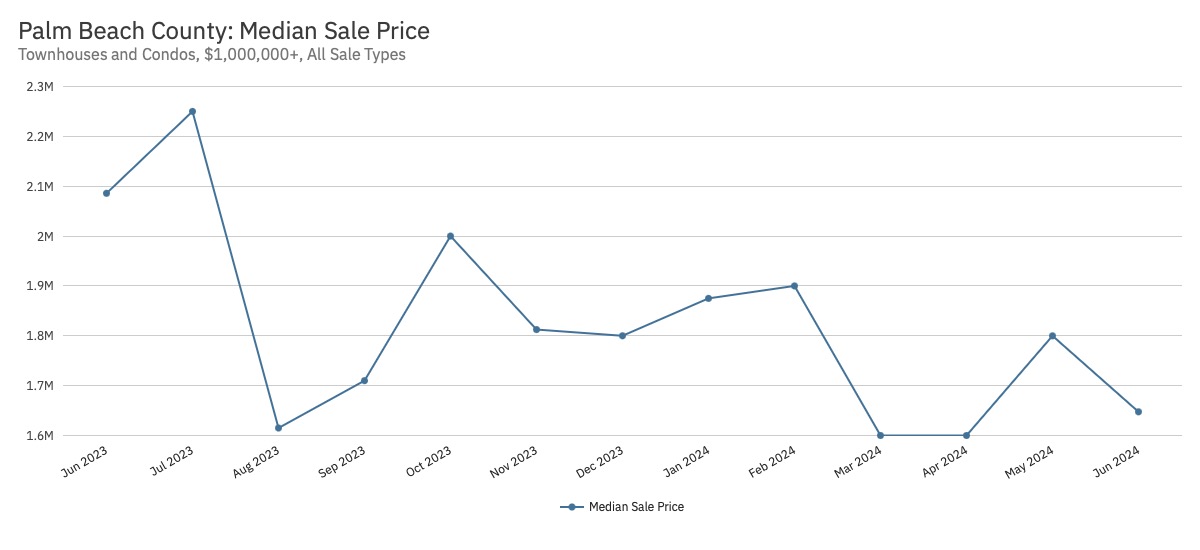

Median Sales Price

Observations:

Observations:

- The median sales pricing of luxury townhouses / condos in Palm Beach has been fluctuating over the last year but trending down. 7 months have seen YoY gains, with 5 months in decline or flat. After a run-up, median sales pricing at the end of Q2 2024 is just above the mark from August 2023.

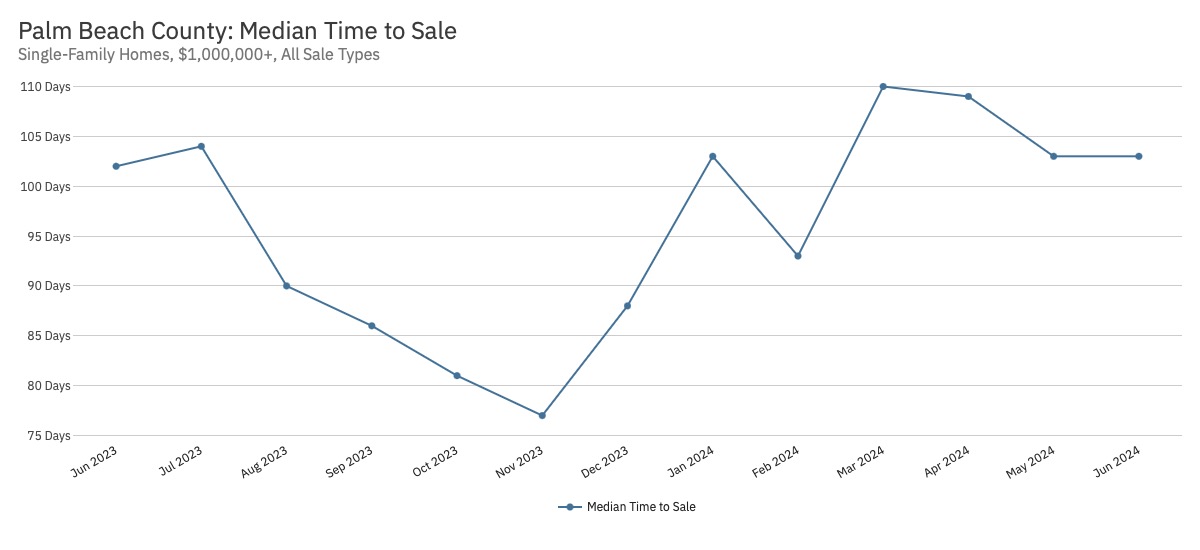

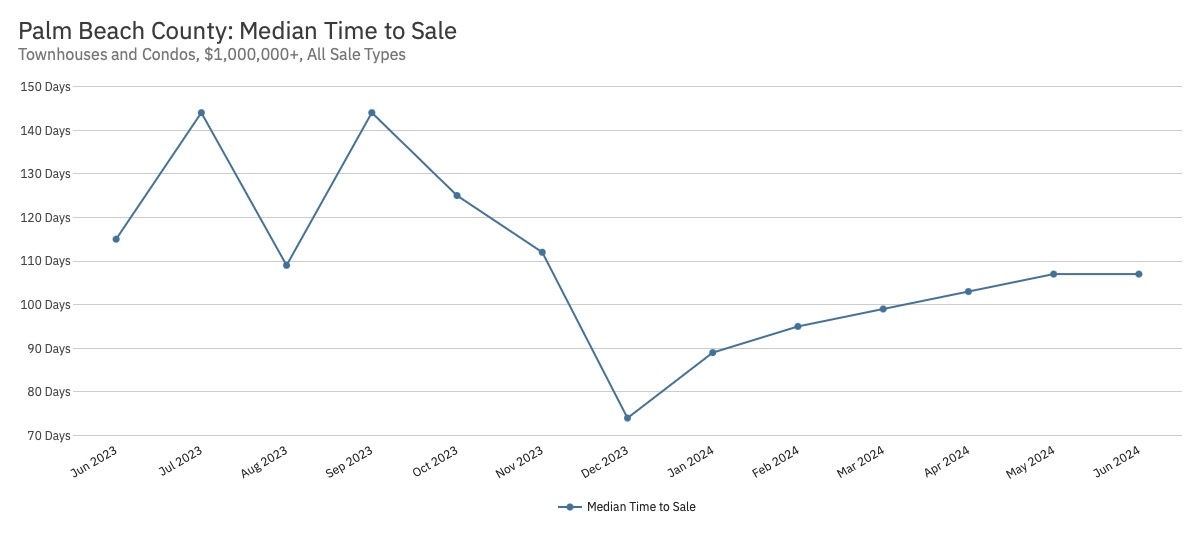

Median Time to Closed Sale

Observations:

Observations:

- The median time to closed sales of luxury townhouses / condos in Palm Beach has been on the rise since December 2023, following a long period of decline. 8 out of the last 12 months have seen increases (or are flat) in the time it is taking to get to the closing table YoY. The time on market is similar to other in-demand communities of South Florida and is largely within the 4–6 months most luxury sellers with realistic pricing goals should expect.

Active Inventory

Observations:

Observations:

- Consistent with national, regional, and local trends, active inventory of luxury townhouses / condos in Palm Beach has been rising steadily since the summer of 2023. All of the last 12 months have seen YoY gains in active inventory compared to the prior year. There’s no doubt increased inventory is due to pent-up seller demand from the last few years coupled with those looking to get into the hot market.

New Listings

Observations:

Observations:

- Contrary to national, regional, and local trends, new listing inventory of luxury townhouses / condos in Palm Beach has been declining this year. However, 9 of the last 12 months have seen YoY gains in new listing inventory compared to the prior year.

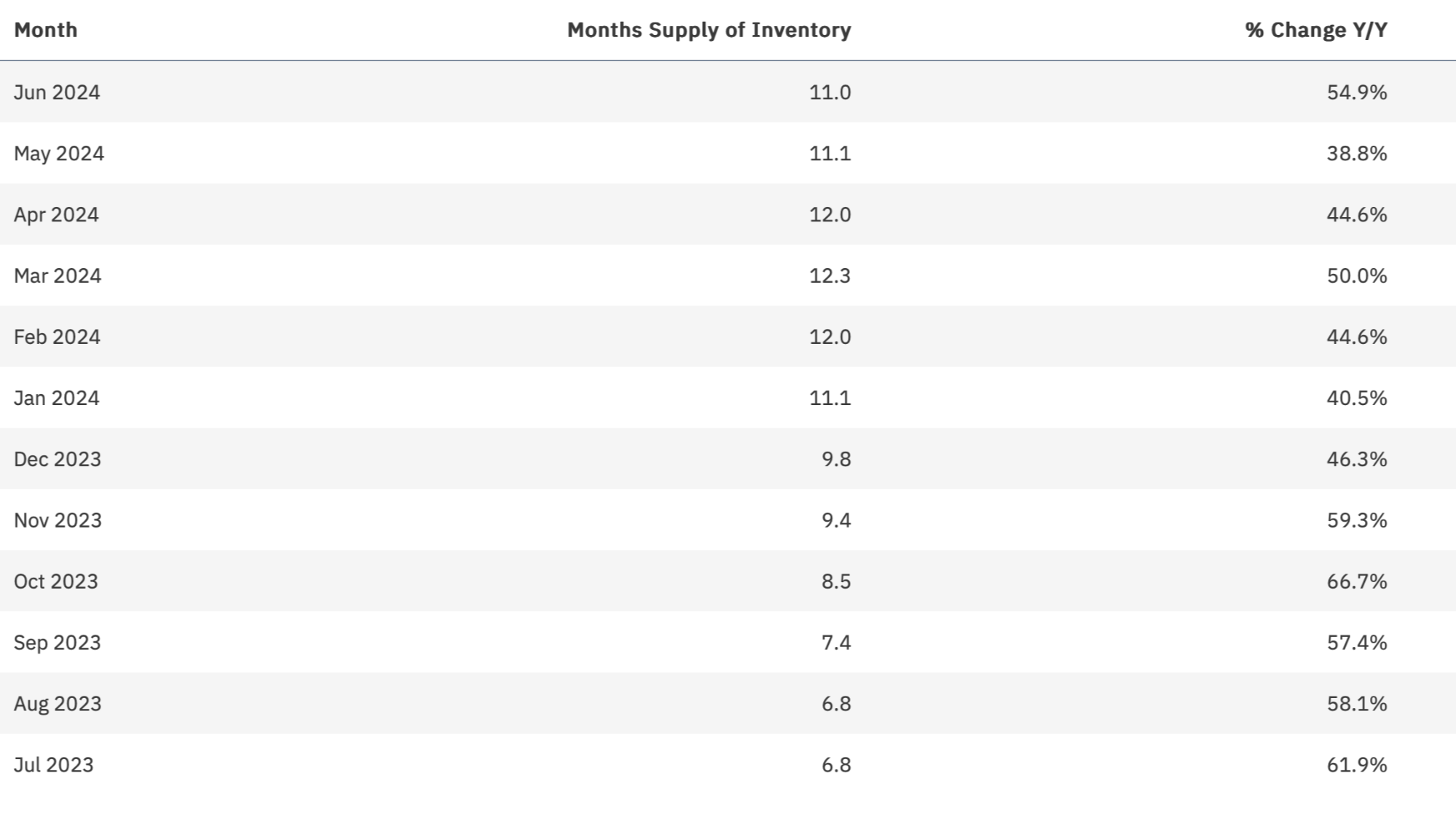

Months of Supply

Observations:

Observations:

- Months of Supply is another way of looking at the health of the market (buyers, sellers, or neutral). Consistent with national, regional, and local trends, supply is growing this year in Palm Beach (county) for luxury townhouses/condos. YoY change has seen gains in all of the last 12 months compared to the prior year. For this property type, the data says it’s a buyers’ market. With the climb in inventory and drop in median sales prices, the overall Palm Beach market for this property type is in a cooling period.

DISCLAIMERS AND NOTICES

- Data relied on within this blog and market report are from i) BeachesMLS and ii) MIAMI Association of REALTORS as of the date of this blog. This data is not verified for authenticity or accuracy and may not reflect all real estate activity in the market. Based on information © 2024 BeachesMLS, Inc.

- This blog and market report are not to be considered investment advice nor a solicitation for investment.

- Purchasing or selling real estate is an important financial decision. Make your own buying, selling, or investment decision based on your own analysis and due diligence, along with the consultation of your own professional advisors.

- The content of this blog and market report is for information and educational purposes only. Any commentary is solely the professional opinion of Jennie Frank Kapoor and/or Tropical Phoenix Homes and does not reflect the opinion of Engel & Völkers, any MLS, Florida Realtors, nor any other group. Errors and typos are possible, and you should verify all information before taking any actions.

- Copyright © 2024 of all original photos and content within this blog and market report, which are the property of Engel & Völkers, Jennie Frank Kapoor, Florida Realtors, and/or Tropical Phoenix Homes (“IP Holders”). No photos or content may be utilized or reproduced without the prior written consent of the IP Holders.

Categories

- All Blogs (44)

- Bahamas (3)

- Boca Raton (1)

- Brand Partners (1)

- Broward County (10)

- Coconut Grove (1)

- Coral Gables (7)

- Delray Beach (1)

- E&V Global (3)

- Events (1)

- Fort Lauderdale (13)

- Key Biscayne (1)

- Lauderdale-by-the-Sea (4)

- Market Report (16)

- Miami Beach (1)

- Miami-Dade County (3)

- New Construction (1)

- News and Updates (11)

- Open Houses (1)

- Opportunities (4)

- Palm Beach (Town) (1)

- Palm Beach County (1)

- Podcasts and Videos (13)

- Pompano Beach (2)

- Sea Ranch Lakes (8)

- South Florida (7)

- Thicken the Plot Series (7)

- Values Series (10)

- West Palm Beach (1)

Recent Posts